It is a good practice to check free CIBIL report before applying for a Loan from any Bank or NBFC. Because the CIBIL report is checked by almost every Lender before approving any Loan to an individual or any business. For a Consumer a CIBIL Score above 750 is generally considered a good score, however, if you have a CIBIL score below 750 then you have to search for a Bank or an NBFC that can provide you a Loan with low CIBIL score.

Step-by-step process to check free CIBIL report:

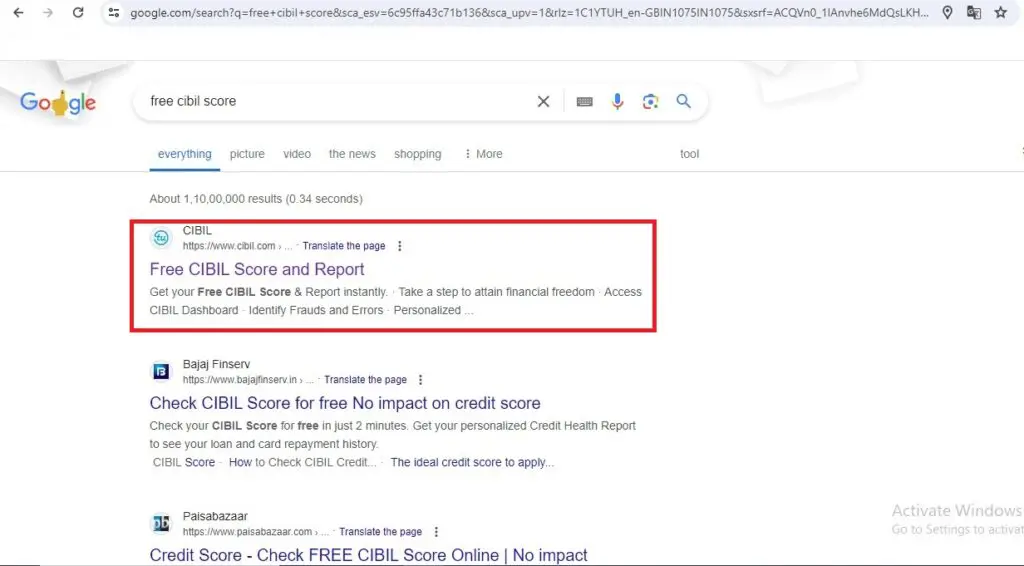

Step 1: First, you need to search on Google “Free CIBIL Score” to check free CIBIL report.

In the first search result, you will get the above link after clicking on the link you will get to see the below Page. Also, you can write down cibil.com/freecibilscore over the search bar directly to check free CIBIL report.

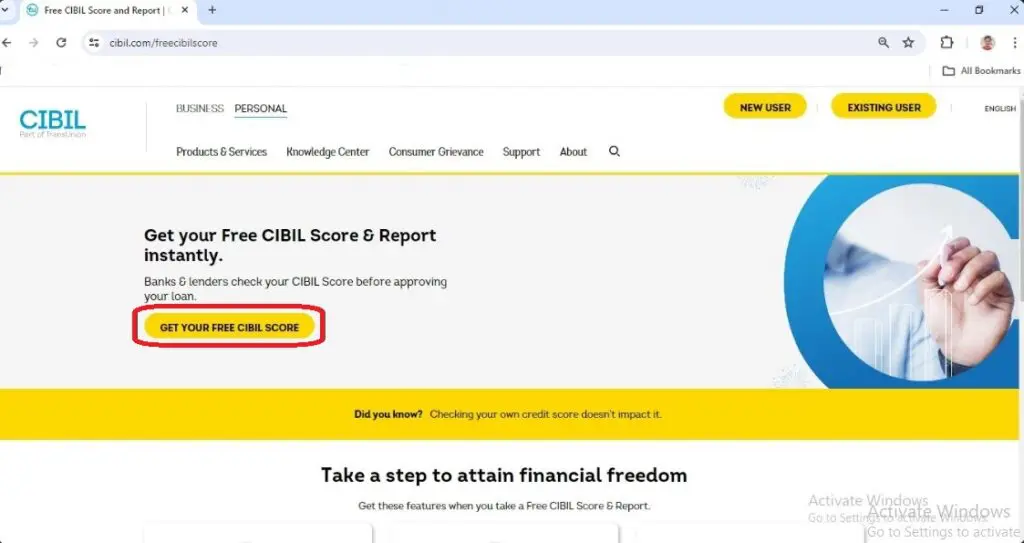

Step 2: On the above page, you will see an option “GET YOUR FREE CIBIL SCORE” After clicking on it the below page will appear.

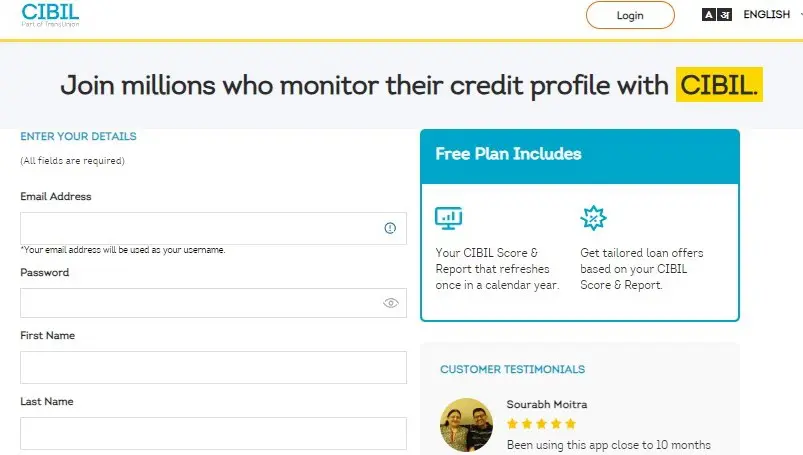

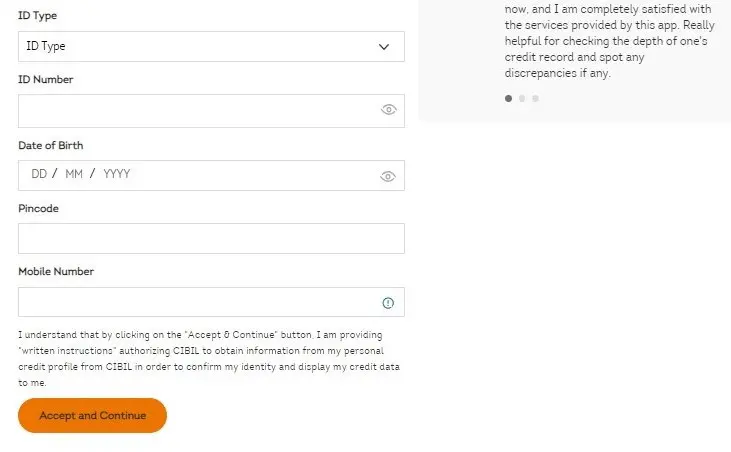

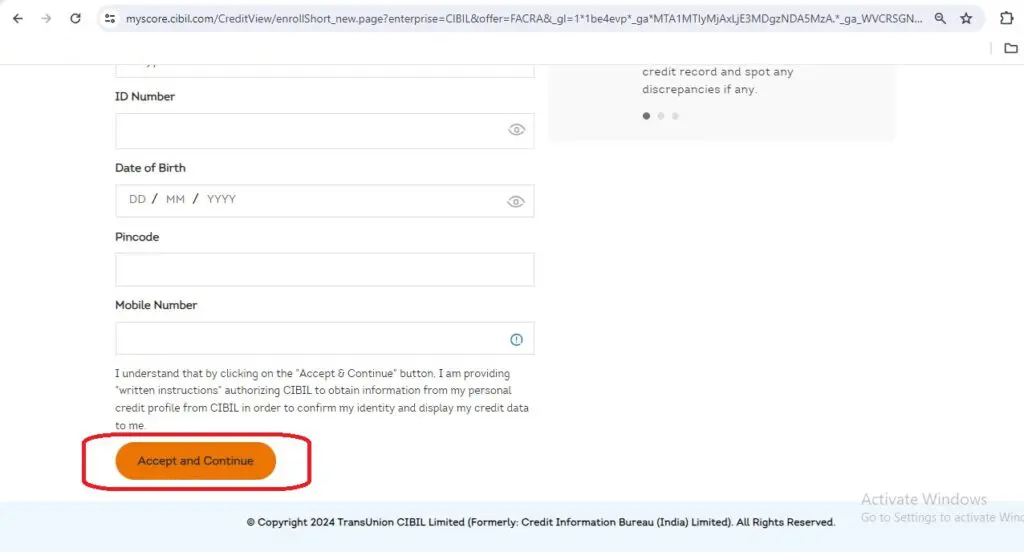

Step 3: You can see some details that need to be filled over the above page to check free CIBIL report, those details are – Email Address and Password (The password should contain one upper case, one lower case, one special character, and one numeric character), First Name, Last Name, ID Type (PAN Card would be preferable), ID Number, Date of Birth, Pin code, Mobile Number.

Note: Remember to register the mobile number and Email ID that is linked to your loan accounts, otherwise you will not be able to check free CIBIL report. And might face issues retrieving your account again.

After filling in all the details click on “Accept and Continue” to register.

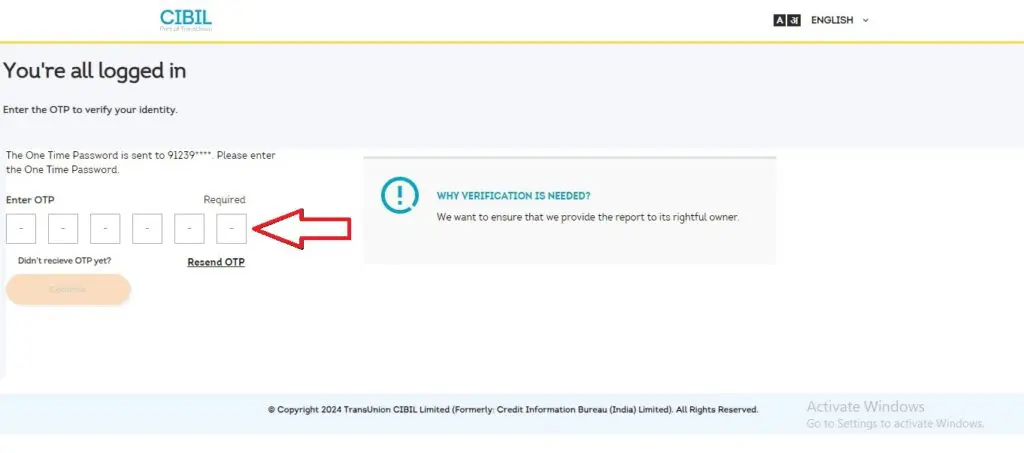

Step 4: Once you click on Accept and continuea6-digit OTP will be sent from CIBIL to your registered mobile number to authenticate. Fill in the OTP and click on the Continue option to check free CIBIL report.

If you have not received any OTP then need to click on the Resend OTP option to get the OTP again.

Remember:

If you have registered using any other phone number that is not linked to your loan accounts then CIBIL will ask some verification questions, so you have to be ready with all your KYC documents like driving license, voter card, PAN, and Aadhar card etc, and recent loan account details.

If the verification fails then CIBIL will block the process of account creation for you temporarily. In this regard, you have to call the CIBIL helpline for further unblocking process.

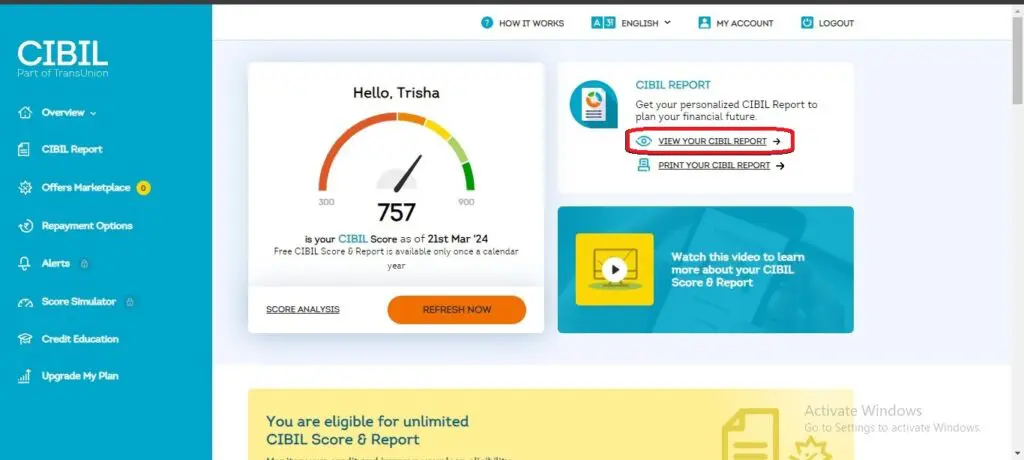

After successful authentication, you can see all your CIBIL account details will be fetched right in front of the screen. And your 3-digit credit score will appear on the screen.

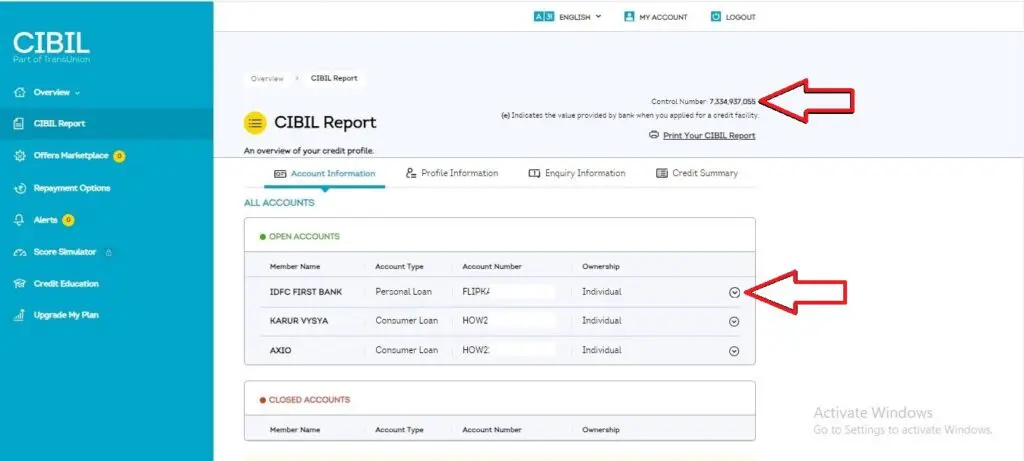

Step 5: To check free CIBIL report you can click on the view your CIBIL report option and the below Page will open.

You can see all the open and closed credit accounts on this page, and by clicking on the dropdown arrow right beside the ownership option you can view all the detailed information of that particular account. With every CIBIL report a unique control number gets generated which refers to the particular report.

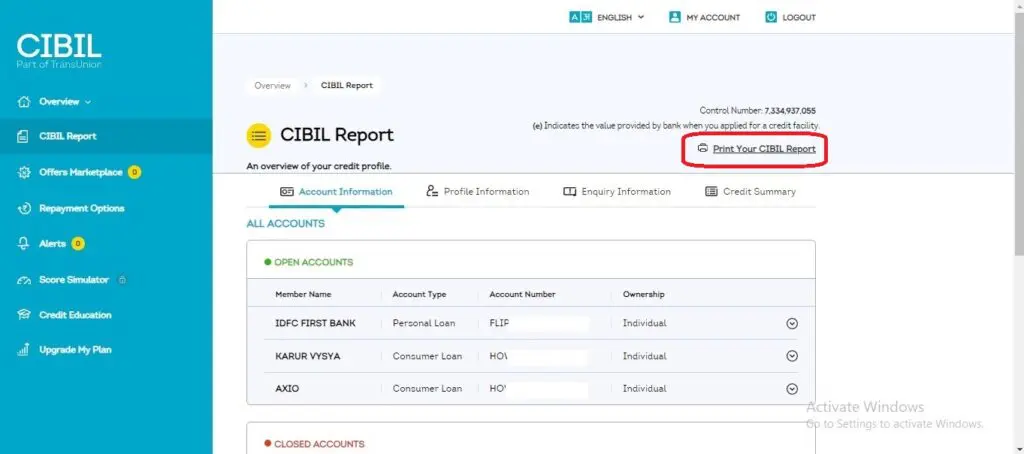

Step 6: To check free CIBIL report in detail you can also download the CIBIL report from the Print Your CIBIL report option right beneath the control number as shown in the below image.

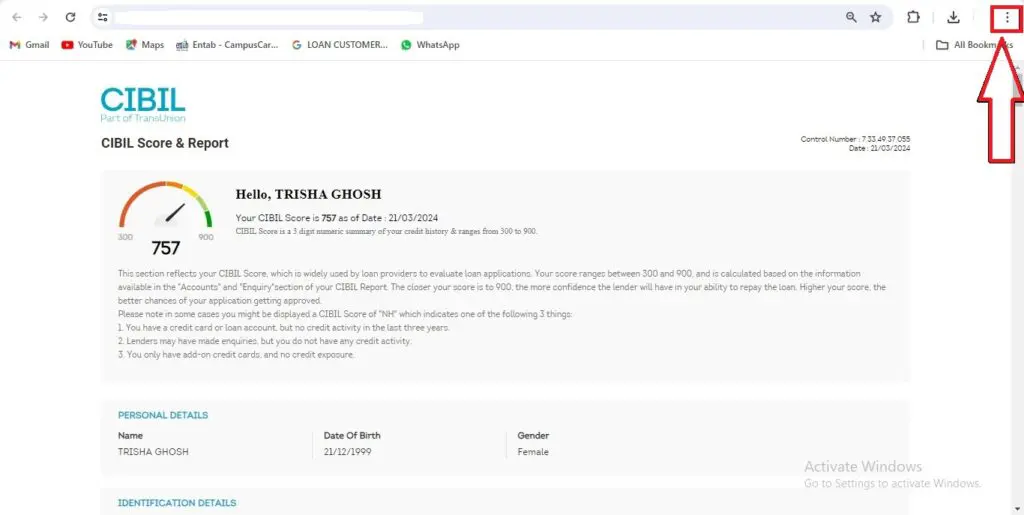

Step 7: After clicking on the Print Your CIBIL Report option the below page will appear and you can see a three-dot in the top right corner.

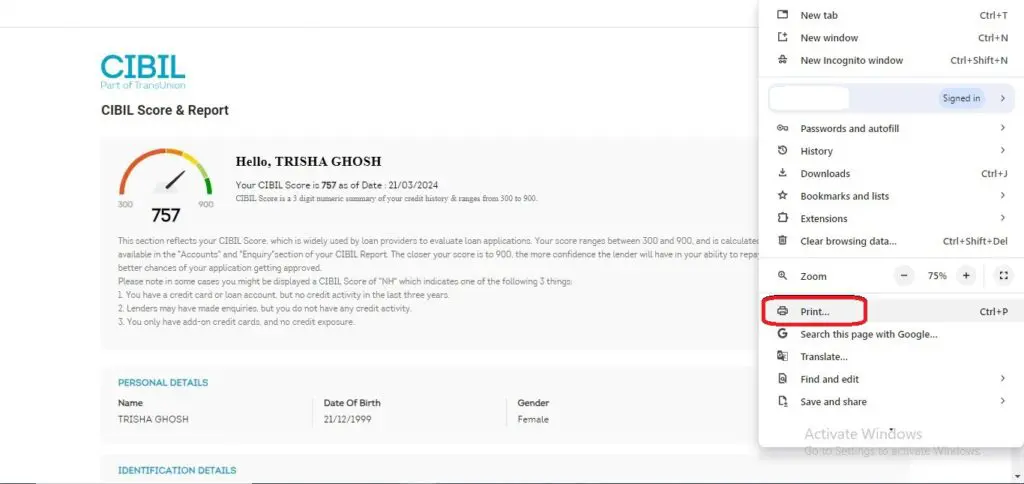

After clicking on the three dots option you can see a print option in below, Click on that and save it to your device for further use.

Note:

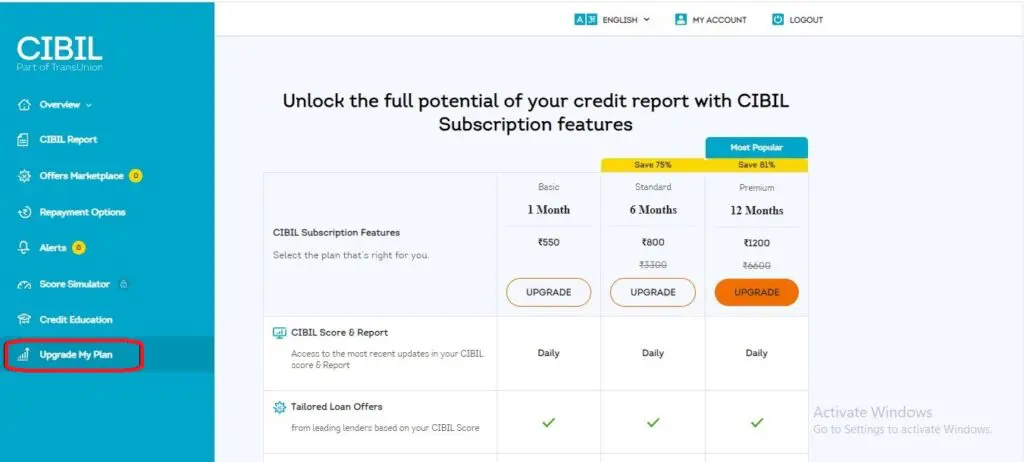

CIBIL provides free reports to customers once a year, if you have already accessed your yearly free report then you will not be able to access it again you can only download it, and if you want to see the updated report then need to buy a subscription plan by clicking on the upgrade my plan option.

In the below image, you can see an overview of the page from where the CIBIL report subscription can be purchased.

Read more:

- How to rectify CIBIL report in 2024?

- How to remove Settled Loan from CIBIL report?

- How to write complaint in CIBIL?