What is CIBIL rank? We know, what is CIBIL score? At least, those people know about CIBIL score who was taken a loan or applied for a loan. CIBIL score is a credit score of an individual person. Similarly, CIBIL rank is for the company.

CIBIL Rank is a number which derives from companies’ credit report. CIBIL rank can be between 10 to 1. It is good if it is “1” or near a number of ‘1’. Most of the bank provides a loan to those companies that have CIBIL score between ‘1’ to ‘4’. How to check CIBIL Rank and Company Credit Report (CCR).

One should check CIBIL rank and CCR before applying for a loan in the name of a company. CIBIL rank is generated to those companies name whose outstanding loan is between 10 lakhs to 50 crores. Otherwise, you will get only CCR.

What is CCR?

CCR full form is Company Credit Report. Companies’ credit report is similar to an individual credit report. Here, you will see companies’ basic detail and credit history of the company.

If you check CIBIL rank and CCR before applying for a loan in the name of the company you can protect rejection of loan application due to bad CIBIL rank and CCR. Sometimes there is an error in the CIBIL report due to many reasons. If you find it early then you can rectify your CCR and increase CIBIL rank. Now your loan possibility can be high.

How to check CIBIL Rank and Company Credit Report – Step by step process

First, visit www.cibil.com. You will get the front page of the CIBIL website. Then scroll down and you will see the subscribe button mention with an arrow in the below image.

Click on the subscribe button. You will reach subscription page.

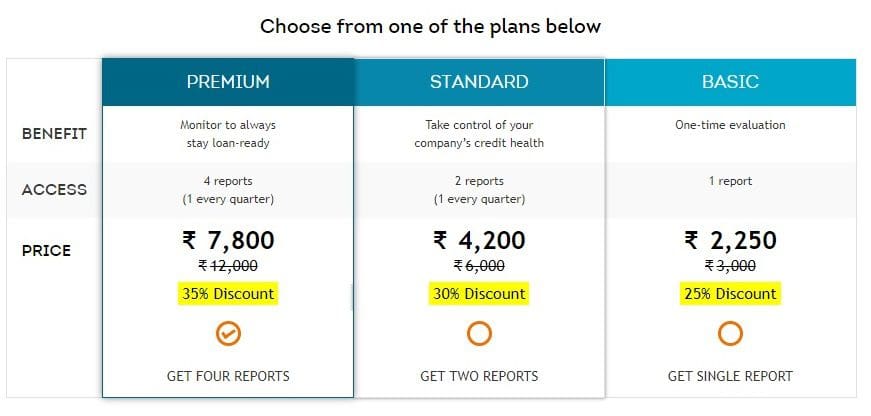

There are three plans. They are premium, slandered and basic. You will get single report in the basic plan. If you would like to check your CIBIL rank and Company credit Report for a loan application only then take basic plan.

Disclaimer: We are not associated with www.cibil.com and we do not sale product or services of Transunion CIBIL.

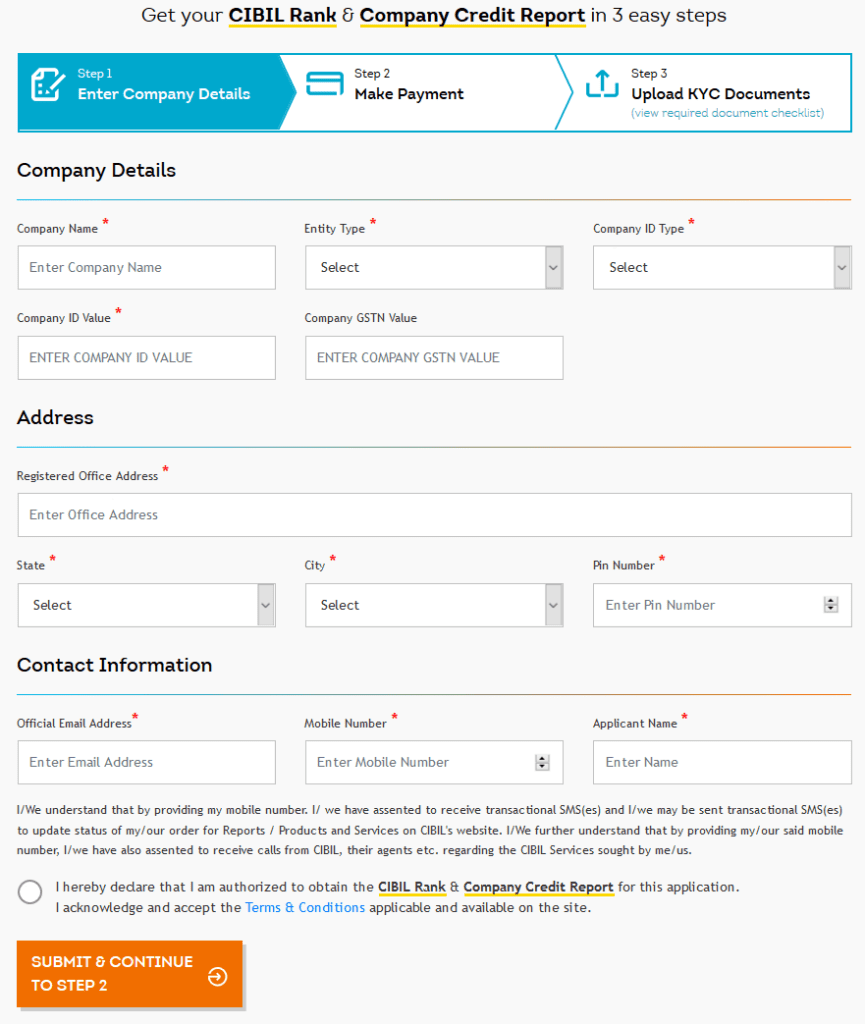

Fill up below mention online from.

There are three steps –

Enter company detail:

First company name, then select types of company. Like proprietors, Partnership company, Private Ltd. etc. Then you have select ID type. You can choose any of the ID cards

- PAN Card ( Company)

- CIN number ( Corporate Identification Number)

- Company Registration Number (CRN)

- Tax Identification Number (TIN).

Provide the company ID value as per your ID type selection.

Next, fill up the registered office address in the form.

Then fill up an e-mail address and mobile number. Fill up applicant name in the list box. Generally, It will be the company owner’s name. Here, you must remember the mobile number and the e-mail address you provide that should be available in your previous loan in the name of the company.

Then tick mark in the checkbox for declaration.

Click on the submit button.

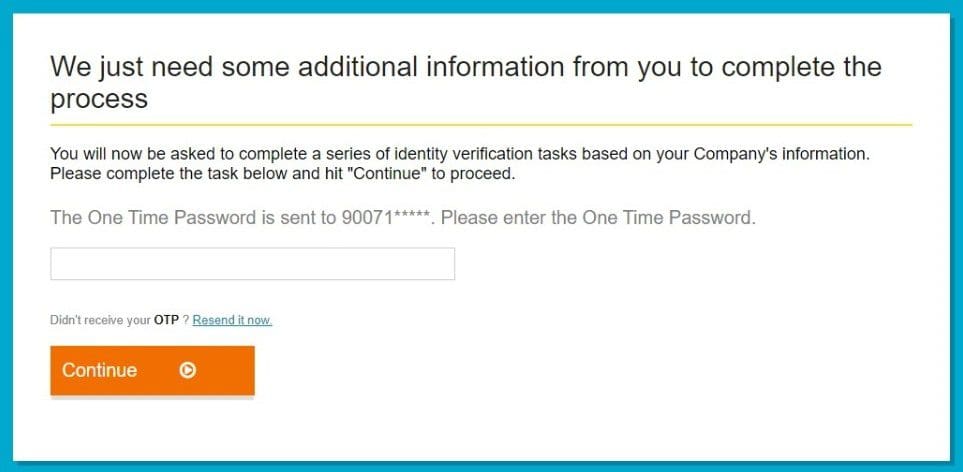

You will find below mention page and an ‘OTP’ will be sent to your registered mobile number.

You have to put the OTP above mention box and continue. You will get payment getaway page. You can pay through net banking, credit card, Debit card or UPI.

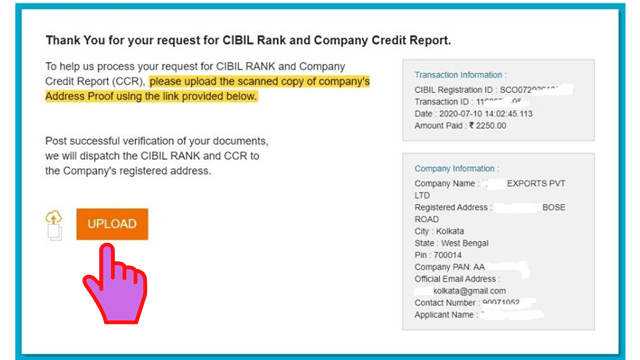

After successful payment, you will get below page and you have to upload the entire document with a signature.

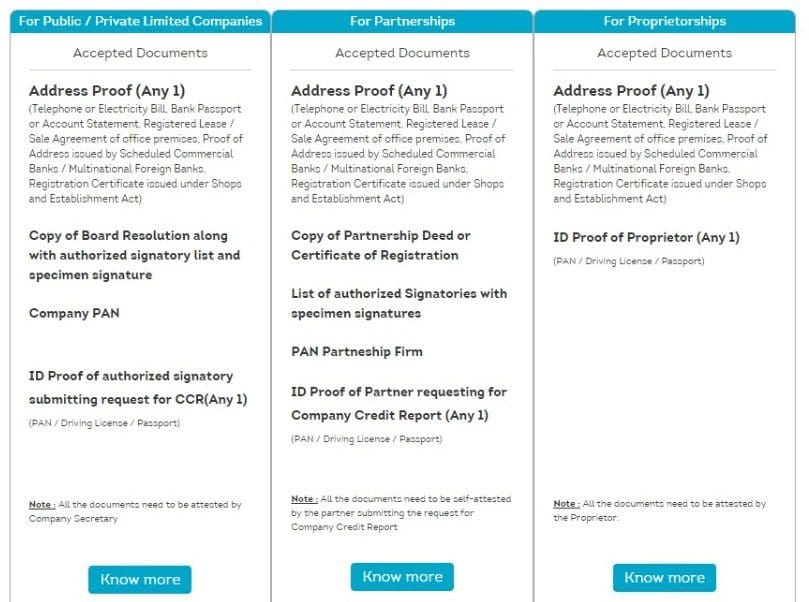

If your company is a private limited company then you have to upload the following documents.

- Address proof. (Address proof can be an electric bill, phone bill, bank account statement company registration certificate etc.)

- Copy of Board Resolution along with authorised signatories.

- Company PAN

- ID proof of Authorised signatories.

(PAN/ Driving license/ Passport)

All documents to be self-attested by the applicant.

In case of Partnership Company:

- Address proof:

- Electric bill,

- Phone bill,

- Registration certificate issued under shops and establishment act.

- Copy of partnership deed or certificate of registration.

- List of Authorised signatories with specimen signature.

- PAN of Partnership firm.

- ID proof of Partner who requesting for company credit report

## All documents to be attested by the partner who will request CIBIL rank and company credit report.

Proprietorship Company:

The following document to be uploading –

- Address proof.

(Electric bill/ Phone bill/ bank account statement or registration certificate.)

- ID proof of proprietor.

(PAN/ Driving license/ Passport)

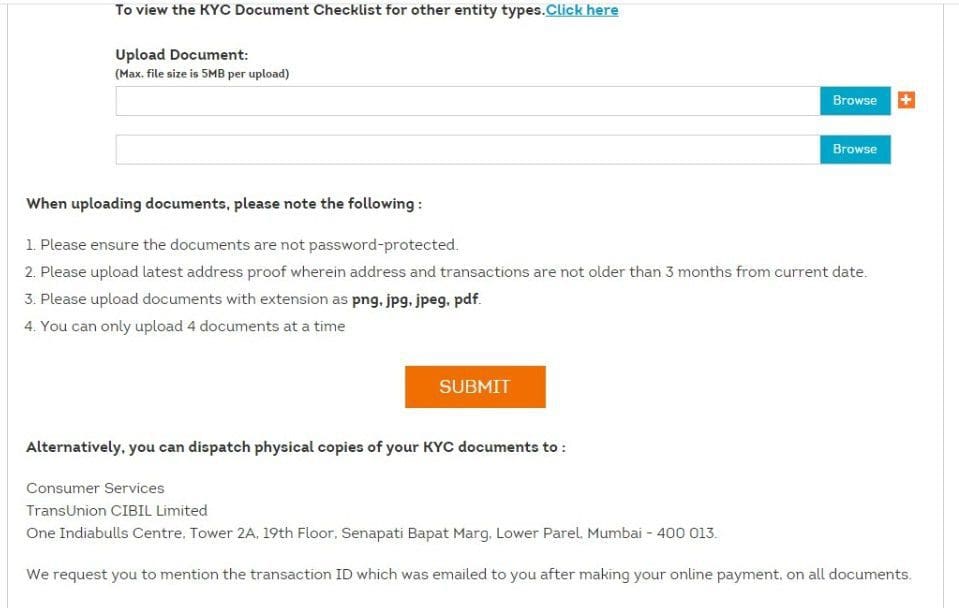

You can upload a maximum of four documents and a single document’s maximum size can be 5 MB.

Click ‘+’ button upload more than two files.

When you upload documents remember the following thing:

- Documents should not be password protected.

- Address proof should not be more than three months old.

- Documents have to be in png, jpg,jpeg, pdf file format only.

After upload, all the documents click on the submit button.

Then you will see a success message and an e-mail will be sent your registered email ID. You will get your CIBIL rank and CCR (Company credit report) by post to your registered office address.

If you unable to upload documents then you can send all the documents (Physical copy) to the following address:

Consumer Services,

Transunion CIBIL limited.

One Indiabulls centre.

Town 2A, 19th Floor. Senapati Bapat Marg.

Lower Parel, Mumbai- 400013

### Write transaction ID on all the documents that e-mailed to your e-mail ID after making payment.

Read also-

- How to check free CIBIL score

- How to correct CIBIL report and increase CIBIL score

- CIBIL Score repair agency

- How to improve CIBIL score

Pingback: What is the difference between CIBIL Rank and CIBIL Score?