When it comes to a loan application, you must ensure that the information mentioned in your CIBIL report is completely error-free, accurate, and up-to-date. Otherwise, any kind of inaccuracies not only harm your CIBIL score but also affect your creditworthiness. If you find errors in your CIBIL report, your first and foremost responsibility should be to rectify them by bringing your complaint to the CIBIL’s concerned authorities. In fact, on the TransUnion CIBIL Official website, multiple channels are available through which an individual can approach their Customer Support Team. Today, in this article, we have discussed one of the most effective ways to rectify your CIBIL report and provided step-by-step guidance on how to write a complaint in CIBIL.

Additionally, we will explain the recent changes and the RBI’s new compensation policy for delays in dispute resolution.

Why should you go for a written complaint?

Before starting a deep discussion, let’s understand the additional advantages you will get with this method.

I. Option to Attach Supporting Documents with the Complaint:

As I mentioned earlier, CIBIL offers multiple channels to address a customer’s complaint. In terms of rectifying the CIBIL report, one of the most popular and convenient methods is ‘Raising an online dispute through myCIBIL portal’. However, this method has a drawback: you can’t attach any documents along with your complaint.

Actually, when you complain about some incorrect information in your credit report, TransUnion CIBIL forwards the disputed details to the respective lender to verify its authenticity.

If you could attach supporting documents (such as KYC documents, payment receipts, loan closure letters, etc.) with your complaint, it would help them understand your concern in a better way, and it also significantly increases the likelihood of resolving the issue compared to simply “raising an online dispute through the myCIBIL portal”.

In case you have already raised a dispute through the myCIBIL portal, and your concern is still pending, then you should write a complaint in CIBIL along with the evidence that supports your claim.

II. Able to complain in CIBIL despite having CIBIL login-related issues:

In the digital era, there are numerous tutorial videos and articles on CIBIL report rectification, empowering individuals to correct their CIBIL reports on their own easily. However, some people encounter login-related errors when they try to register or log into theirCIBIL portal.

If you are facing similar issues and cannot log into your ‘myCIBIL’ portal, then submitting a “Written Complaint” is your best alternative to initiate a dispute with the TransUnion CIBIL. Additionally, this method can help resolve CIBIL login-related issues.

III. For the error, only present on the bank’s Report:

Let’s consider a situation, where you apply for a loan at a bank. During the loan processing, the bank manager checks your credit report from their banking server and informs you of an unknown default loan listed on your CIBIL report. However, when you check your CIBIL report on the TransUnion CIBIL official website, you find no such issue.

Usually, this kind of error typically occurs due to discrepancies in how the bank retrieves or processes your CIBIL data. Since the default loan does not appear on the CIBIL official site’s report, you cannot raise dispute through your ‘myCIBIL portal’. In this scenario, you need to submit a written complaint using the specific report generated by the bank.

Additionally, by following this method, you can address issues for both Commercial and Consumer CIBIL reports.

Steps to be followed to write a complaint in CIBIL:

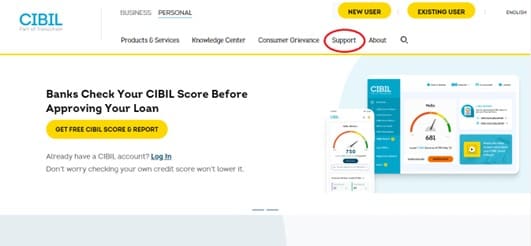

- First, you need to visit the TransUnion CIBIL’s Official website cibil.com. On the top right corner of CIBIL’s home page, you will find the options for “Support” as highlighted in the below picture. Click on the “Support” and move forward.

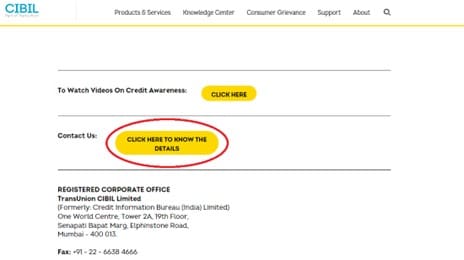

2. Then, CIBIL’s Customer Support page will open to you. On this page, you may find some important links related to Individual and Commercial CIBIL reports. Slightly scroll down the page, and you will get the options for Contact Us: Click here to know the Details” as marked on the picture below. Click on the yellow button to proceed further.

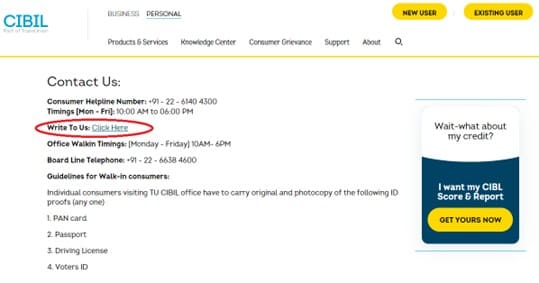

3.On the next page, you will get the final link to write your complaint to CIBIL’s customer support team. Click on the link as highlighted in the below picture.

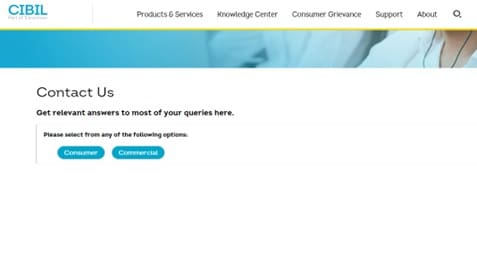

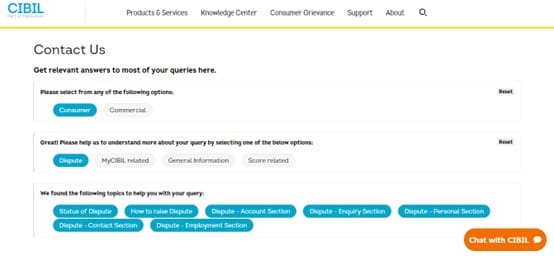

3.On the next page, you will see two options: ‘Consumer’ and ‘Commercial’.

I. Consumer: Select this option if you have concerns related to your individual credit report. This may include incorrect information in your CIBIL report, login issues, or queries related to your CIBIL score.

II. Commercial: Choose this option if you have complaints or queries regarding your commercial CIBIL report or rank.

Since the overall process is quite similar in both cases, that’s why, from this onwards, we have explained the further steps for Individual customers. So, click on the “Consumer”.

5.Under the Consumer section, you will find four subsections:

- Dispute: Select this if you want to report any inaccurate information in your CIBIL report.

- MyCIBIL Related: Choose this if you are experiencing login-related system errors and need to lodge a complaint.

- Score Related: Use this for any queries related to your CIBIL score.

- General Information: For any other general inquiries.

For example, you have an unknown loan account in your CIBIL report and you want to raise a dispute to remove them from your CIBIL report. For this purpose, choose the option “Dispute”.

As here your dispute is related to the account section, so go for the option “Dispute- Account Section”.

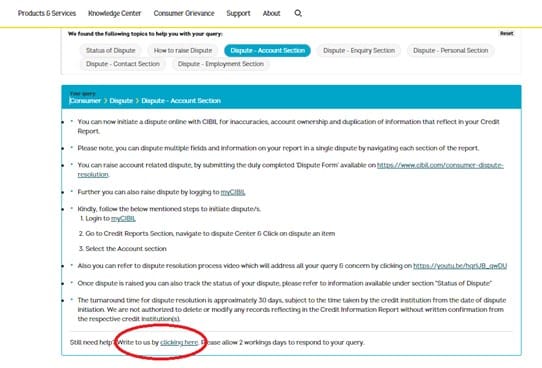

6. Then a query box will open. On the downside, you get the option “Write to us by clicking here” as highlighted in the picture.

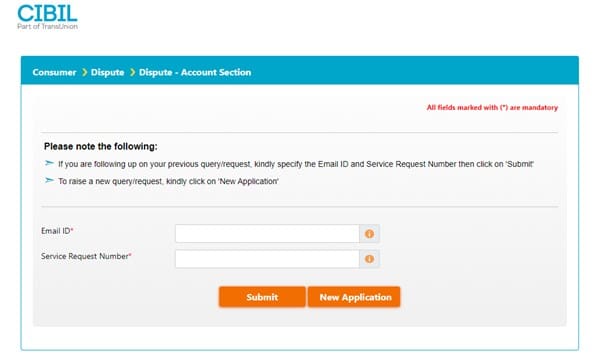

7.Next, you will get a form, where you need to put your Email ID and Service Request Number. If you are going to raise a complaint for the first time and you don’t have any Service Request Number, then click on the “New Application”.

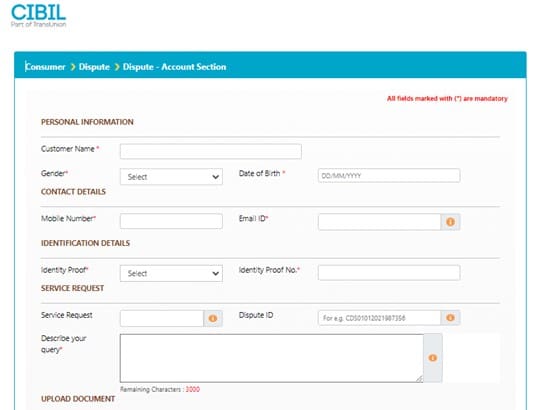

8. On the next page, the actual “Account Section” form will open. Fill out the form with your name, date of birth, contact details, and identification details. Try to use the email ID and mobile number that is mentioned in your CIBIL report or those you had used at the time of registration. Select PAN Card as the identity proof and provide the corresponding number.

If you have any prior Dispute ID or Service Request Number, mention those as well, though it is not mandatory for all.

In the query box, write a brief description of your complaint within 3000 characters. Be sure to mention the CIBIL report control number, so that the CIBIL Customer Care Support team can retrieve your credit report from their end.

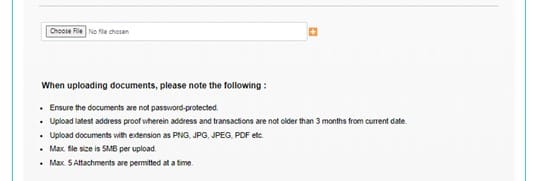

Attach all necessary documents related to your complaint, such as your KYC documents, CIBIL report, and payment details (if applicable). Note that all documents should be in PDF, PNG, JPG, or JPEG format, should not be password protected, and must be under 5MB in size.

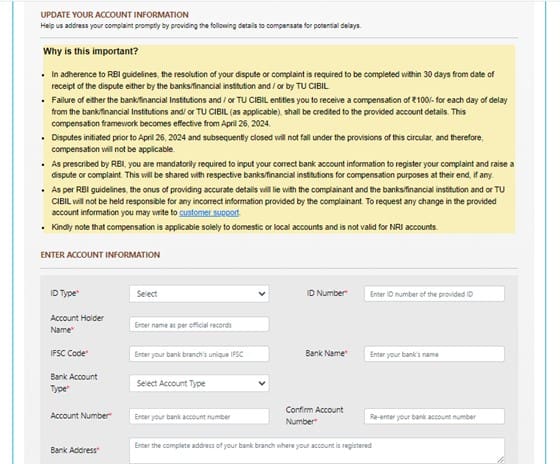

9.At the very beginning, we were informed about a recent change in the process of raising disputes with CIBIL. You will notice a special addition in each complaint form, where you must provide your savings or current account details.

These changes are made according to the RBI’s new compensation framework (RBI/2023-24/72 dated October 26, 2023). As per the new guidelines, if TransUnion CIBIL fails to resolve your complaint within 30 calendar days from the date the complaint was initiated, CIBIL will be obligated to pay a compensation of Rs. 100 for each day of delay. The compensation amount will be credited to your account within 5 working days from the complaint resolution date.

TransUnion CIBIL implemented the RBI’s instructions on April 26, 2024. According to the new changes, you need to provide your savings or current account details to claim the compensation (if applicable).

Therefore, enter your savings or current account details, including the bank name, account number, IFSC code, address, and account holder name. Note that for any inaccuracies in the account details, TransUnion CIBIL will not be liable if the compensation amount is credited to the wrong account.

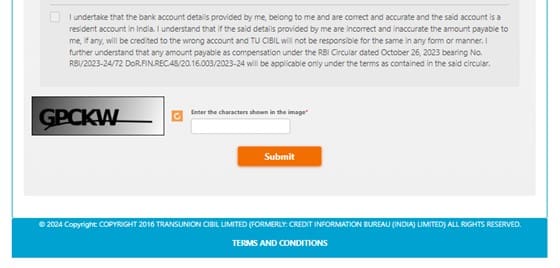

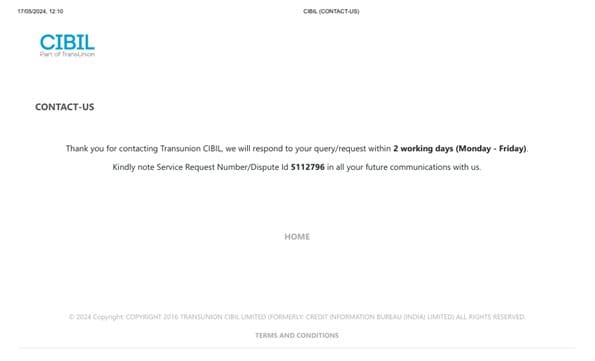

10.Then select the checkbox and enter the captcha mentioned in the image. Proceed to the final submission. After successful submission, a Service Request Number will be generated, as shown in the picture below. Additionally, you will receive an email confirmation from CIBIL. Follow up with CIBIL until the dispute is resolved in your favor.

Send a complaint to the lender:

When you are going to write a complaint in CIBIL, additionally, send a separate complaint to the respective lender. As we mentioned earlier, CIBIL will forward your complaint to the respective lending institution to verify the information in your CIBIL report. Once they receive both parties’ complaints simultaneously, they will resolve the issue on a priority basis.

Read more about CIBIL rectification:

- How to remove Settled Loan from CIBIL?

- How to rectify CIBIL report in 2024?

- How to write complaint in CIBIL through Email?

Pingback: How to contact CIBIL customer care?