In the modern world of business banking every business entrepreneur whether a self-employed professional or self-employed non-professional doing entrepreneurial ventures seek the financial boost either by availing a short-term working capital loan like cash credit or a term loan in order to meet the financial requirements of the business. So, the difference between cash credit and term loan becomes very much important aspect while understanding the purpose of availing a loan.

What is Cash Credit?

A cash credit is a short-term working capital loan provided only by the schedule banks for a maximum period of twelve months on renewal basis preferably to the entrepreneurs who are majorly into manufacturing and trading businesses.

It is applied with the banks to meet the regular expenses only related to the business like purchasing raw materials for production, payment of wages and salaries of labourers and staffs, debt consolidation and meeting up the creditors of the business, maintenance and repairs of plants and machineries installed for manufacturing, expenses related to business logistics of trading etc.

Features of Cash Credit:

- Cash credit loan is given to meet the working capital requirements of a business

- It is given against a collateral security.

- Interest is generally charged only on the amount of loan taken by the customer and not on the amount of credit sanctioned

- Cash credit loan is a short-term loan with specified monthly/quarterly repayment structure as decided by the lender

- The applicant is allowed to withdraw the funds made available to him to meet the day-to-day working capital requirement by way of a running account

- A cheque book is issued in the name of the company and they can withdraw funds as per the requirement

- The applicant has the option to repay the loan as frequently as desired (daily/weekly), or as per the repayment structure is drawn by the lender

- Even individual applicants can avail this type of facility against their fixed deposits (as a loan) and save on interest

Advantages of Cash Credit:

- Ease of withdrawing only the amount as and when needed

- It can be withdrawn any number of times within the given limit

- Interest is charged only on the amount withdrawn

- Quicker way of dealing with working capital shortages

Disadvantages of Cash Credit:

- Though interest is charged only on the amount that is utilized in cash credit, the borrower would need to pay a fee for the facility that is made available

- As cash credit is considered as working capital loan, extensive paperwork is required

- If a bigger amount is obtained as a sanctioned amount but fund can only be allowed as per the drawing power so determined and the borrower will need to pay a higher fee for the credit facility.

- The amount may be recalled at short notice. But this happens only when the repayments are not regular).

What is Term Loan?

A term loan is a short-term or long-term loan which may be an unsecured or a secured one provided by both schedule banks and non-banking financial companies (NBFCs) and fintech companies as well for a fixed tenure to fulfill the financial needs of an entrepreneurial organization to meet up the variable expenses, fixed expenses and capital expenses of the organization which may or may not be related to the business.

Types of Term Loans:

Term loans are available in several varieties to suit a borrower’s funding requirements based on factors like

- Amount of funding required

- Repayment capacity of the borrower

- Regular cash flow and in-hand availability of funds

Based on these, the term loan interest rates also vary along with other terms of lending. As per the term loan meaning, these advances are available in the following variants.

- Short-term loans: Tenure ranges between 12 to 18 months and Some lenders, also consider advances of up to 5 years or 60 months as short-term loans. Borrowers usually avail these loans to meet their immediate, medium-sized funding needs that they can repay easily within a short span.

- Intermediate-term loans: Tenure ranging between 3 to 5 years. Borrowers usually avail these loans for making big-budget funding needs of businesses like purchasing machinery purchase, boosting the working capital, etc. Affordable EMIs of these loans allow businesses to repay the loan from regular cash flow.

- Long-term loans: Tenure reach up to 25 years and have attractive term loan interest rates. Easy EMI option makes these advances convenient to repay over the long tenor while fulfilling a business’s requirement for lump sum funding. Usually, such loans are secured in nature.

Advantages of Term Loans:

- Flexibility of tenure allows an option to choose a suitable tenor for loan repayment, borrowers can select a suitable term that allows them pay EMIs as per their repayment capacity.

- Ease of repayment through affordable EMIs -Select a repayment tenor as per your income and keep your EMIs affordable.

- Minimum eligibility requirements and hassle-free documentation –You can easily avail these loans against minimum eligibility and submissions of few basic documents, which makes the process hassle-free.

- Cost of loan limited –You can have an idea of the total cost of loan you are required to pay during the application process itself. It makes budgeting your finances easier.

Disadvantages of Term Loans:

Although term loans are among the best sources of external credit, they must be cautiously used to avoid landing in a detrimental financial circumstance. To do so, borrowers must –

- Keep a track of due dates for EMI payment

- Pay EMIs in time

- Make optimum use of the loan amount

What are the differences between Cash Credit and Term Loan from the viewpoint of a business Organization?

A common option among businesses in need of finance, cash credit and term loan are products to cater to the funding needs of an entrepreneurial enterprises.

A term loan is one where money is made available for a fixed duration, usually anywhere between 1 year to 15 years or even more in some cases.

Whereas a cash credit is one that is taken by business owners to tide over any short-term financial needs or sudden cash crunch, and even to help them keep up their day-to-day operations. Cash credit refers to the money or funds used to run daily business operations and associated expenses.

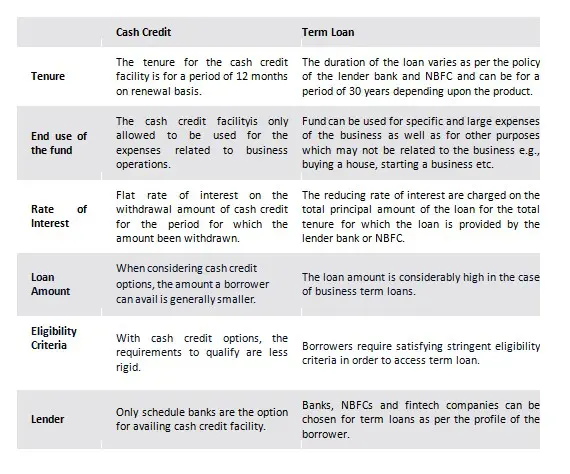

The difference between cash credit and term loan are as under:

Conclusion:

The right financing option between term loan and cashcredit facility totally depends on the requirements of the borrower. Term Loans offer definite repayment tenure and lower interest rates, making them suitable for specific and one-time expenses.

On the other hand, cash credit facility provides flexibility for businesses with fluctuating cash flow needs. It is essential to carefully evaluate the financial targets and assess which option aligns better with the business depending upon the uniqueness of the circumstances and purposes.

Read more: