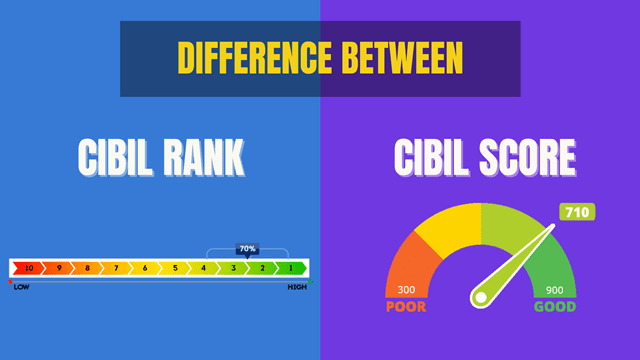

The primary difference between CIBIL rank and CIBIL score is that the CIBIL rank is provided for a company or an enterprise. But, the CIBIL score is provided for an individual.

The CIBIL rank is a number that ranges between 1 to 10, and it highlights the creditworthiness of a company. A CIBIL rank of “1” or a closer number of “1” is always preferable to apply for a loan. It will not be much challenging to get a loan if a

company’s CIBIL rank is lower than 4, as many banks or financial institutions offer loans if CIBIL rank is below 4. One thing must remember, not having a CIBIL rank does not mean that the company is not performing well. Sometimes it is possible to find a “NA”

instead of any number. Transuniun CIBIL issues CIBIL rank for a company only if the company has taken loans between 10 lakh to 50 cr.

On the other hand, the CIBIL score is a three-digit numeric number ranging between 300 and 900. It represents an individual’s creditworthiness so that every credit institution uses a CIBIL score to evaluate a person’s loan repayment possibility. However, a credit

score of 750 or higher is preferable to applying for a loan. A CIBIL score depends on a person’s credit history, total open accounts, debt levels, repayment history, and many other factors.

CIBIL Rank vs CIBIL Score:

To understand the main difference, have a look at the below image to get an overall overview :-