Are you one of them whose Experian credit score dropped 50-80 points suddenly? This change can be a nightmare for you, especially when it happens without any apparent reason. But don’t worry! You are not alone.

Actually, Experian Credit Information Company India Private Limited has recently upgraded their credit scoring model, causing a significant drop in Experian credit scores of many Indian borrowers.

Let’s try to understand the new version of Experian credit scoring model and the consequent changes of it. Most importantly, how you can deal with these changes. So, let’s start the discussion with a basic understanding of a credit scoring model.

What is a credit scoring model and how does it work?

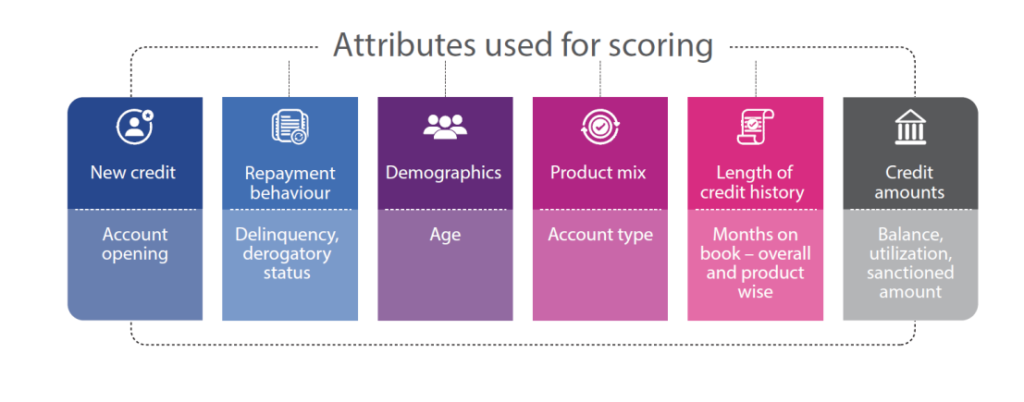

In simple terms, credit scoring model is a mathematical algorithm set by the credit bureaus to evaluate an individual’s creditworthiness using various factors, like loan repayment history, credit utilisation, credit length, types of credit, and so on.

Based on these factors, a credit score is calculated for each individual borrower, typically ranging from 300 to 900. Ultimately, this credit score helps the creditors to assess the risk of lending associated with a borrower.

However, In India, all major credit bureaus—TransUnion CIBIL, CRIF Highmark, Equifax, and Experian India—use their own credit scoring models to evaluate an individual’s credit score.

That’s why if you checked your credit report from all four credit bureaus, you might notice your credit scores are different from each separate credit bureau. In fact, three to four months ago, Experian’s credit score was the highest among all the credit bureaus.

Experian new credit scoring model and changes in consumer credit score:

Recently in Apr 2024, Experian India Pvt Ltd launched their upgraded version of Consumer Bureau Score V3. In the new versions, they made changes in scoring methodology and its features, which is quite different from their earlier version V2.

As a consequence, you might notice a standard drop of 50-60 points in your Experian credit score compared to the previous version.

Most of the consumers have experienced abrupt changes in their credit scores. In fact, in some cases, the Experian credit score dropped by 80-90 points, and even up to 100 points.

But the question remains: what are the changes and modifications Experian made in their new scoring algorithm? Let’s discuss about it.

What are the changes made in the Experian credit scoring model?

In the Experian own words, V3 is the improved version of consumer bureau score, where changes are made in the view of evolving economic and market trends.

Experian new credit scoring model V3 is designed with up-to-date information that helps it to evaluate an individual’s creditworthiness more accurately. In terms of predicting credit risk, V3 outperforms V2.

The main parameters and attributes of the V3 scoring model are loan repayment history, length of credit history, credit utilisation, loan sanctioned amount, number of active accounts, types of credit facility, new credit application, age of the borrower, and so on.

Apart from these, some variables are added on with the V3 scoring model, which covers the new genre of financial products, such as small ticket loans, App-based loans, Buy Now Pay Later (BNPL) loans, Payday loans, and many more.

Its factors also depend on an individual’s credit behaviour (like prepayment, positive loan closer) that help the creditors to make more informed decisions.

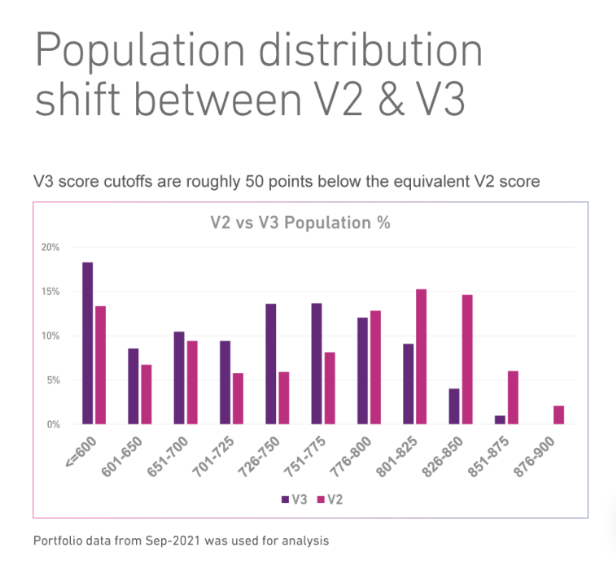

However, at the end of the day, due to all these changes in the scoring algorithm, the Experian credit score is affected drastically for most of the borrowers. On Experian India’s official site, they provided a statistic showing the population distribution shift between V2 & V3.

In the graph, you can see that under the V2 scoring model, most consumers’ Experian credit scores were between 776 and 850. In fact, there was a significant number of consumers with scores between 851 and 900.

However, according to the V3 model, most consumers’ Experian credit scores shifted to between 701 and 775. There are now very few chances of having a credit score above 851, and a large number of consumers’ Experian credit score dropped below 600.

What are the precautions you should take as a borrower?

As we all know, credit score plays the most crucial role in terms of getting loan approval with the preferable rate of interest and loan terms, especially for unsecured loans. Any kind of unexpected drop in your credit score may lead to loan rejection, or you have to compromise with a higher interest rate.

Even though Experian India clarified that all the financial institutes have already incorporated the new changes in their scoring algorithm, but most of the bank managers may not be aware of it.

If there is no issue in your Experian credit report, and the bank manager rejects your application due to only a poor Experian score, then talk with him about the new changes and provide all the supporting documents related to it, so that you don’t have to do any kind of compromise from your financial standpoint.

This is one of the reasons of a sudden drop in your Experian credit score, but you don’t have any control over it, you have to accept the changes done by authorities.

Apart from this, your Experian credit score also be affected due to any kind of delinquency in your Experian credit report, such as an unknown default loan account, negative remarks on your availed credit facilities, etc.

If you notice a significant drop in your Experian credit score, first check the entire report properly. If you notice any error, rectify it by raising your concern to Experian’s customer support team. After all, maintaining error-free credit information is your responsibility.