Is your loan application rejected due to inaccuracy or delinquency in your Equifax credit report? Since Equifax is one of the leading credit bureaus in India, that’s why lenders may check your Equifax credit report along with the TransUnion CIBIL report. If your credit report is not updated properly or any incorrect information is mentioned there, then you should read Equifax credit report properly to rectify all of them.

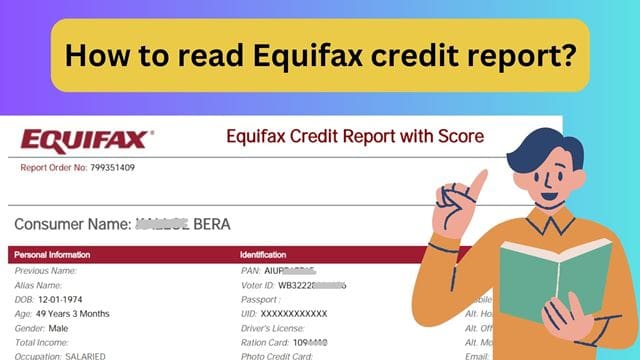

Once you are able to understand the different sections of your Equifax credit report, then it will help you to identify the actual problem & sort it out smoothly by yourself. Here, we have tried to explain each segment of the Equifax credit report with appropriate pictures. And a few details in these pictures are hidden due to security reasons.

Different section in your Equifax Credit report:

1. Equifax Report order number:

Whenever you generate a new report from Equifax’s official website, an order number will be mentioned at the topmost side of the credit report. Along with that, the report generated date & the respective time are also mentioned there. For each fresh report, the report order number will change.

The report order number is the most important information used in the process of rectification. Because, whenever you will write a complaint letter in Equifax, then you have to mention the report number in that email so that they can access the particular report from their end.

2.Consumer Personal Information:

In this section, the consumer’s personal, identification & Contact details are mentioned, like your DOB, PAN Card number, Voter card number, Contact Number & Email id, monthly income etc. You should check whether all of the information is correct or not. If there is any unknown detail present, then it may cause of data mixing-related issue in your Equifax credit report.

3. Consumer Address:

Under this section, all of your addresses are mentioned along with the reported date. These addresses are those which you had submitted to the concerned lending institute at the time of loan approval.

4. Equifax credit score:

Based on your past credit behaviour like loan repayment, credit utilization, credit enquiries, etc; Equifax will generate the credit score. In general, a credit score is a 3-digit number, ranging between 300-900. A score of 750+ considers as good credit score. A higher Equifax credit score indicates the responsible behaviour of the borrower and it increases the possibility of loan approval with a lower interest rate.

5. Recent activity:

All of your recent credit activities (Last 90 days) are mentioned here. If you have recently applied for a new loan/ credit card, then the number of credit enquiries is mentioned here. In fact, the number of your newly opened loan accounts, and delinquent accounts are also mentioned as shown in the picture below.

6. Credit report Summary:

From this section, you will get a demographic idea about all of your loan accounts. As you can see in the picture, the total number of your loan accounts, and how many among them are active, closed, delinquent, etc are mentioned here. In fact, the total Outstanding Balance of your active accounts, your last opened account, oldest account are also reported here of Equifax credit report.

7. Account Details:

This is the most important section of your Equifax credit report. Most of the time, your loan applications are rejected due to the inaccuracy in this particular section. Here, each of your loan accounts is mentioned along with the account number, current account status & repayment history; so that you can find out whether your loan account is updated accurately or not.

The loan Sanctioned amount, Sanctioned date, Current Balance, Past Due (Overdue) Amount, Account Status, Payment history etc are mentioned as shown in the picture below. If you have made any delay in EMI payment, then the number of days will be mentioned month-wise in the repayment history. Sometimes, STD, SMA, SUB, DBT, and NPA can be mentioned instead of the number of delay days.

8. Enquiry Summary & Enquiries:

Whenever you have applied for a loan in any of the credit institutes, then it considers a credit enquiry. And the total number of your all credit enquiries is mentioned in this section along with the particular lending institute name, enquiry date & the loan purpose.

But, a large number of enquiries in a very short period of time shows the credit-hungry behaviour of the borrower. And it may decrease your Equifax credit score rapidly. So, you should be careful before applying for a loan in different lending institutes simultaneously.

All of your KYC related details, you have submitted at the time of loan application are mentioned here as Input Enquiries.

9. Abbreviation Code & its description:

In the account information section, you can observe there some abbreviations are mentioned to indicates the current status & repayment of the account. That’s why you should know about each abbreviation and what it’s means.

This is the all about the Equifax credit report; hope this will help you to understand the different portion of the credit report. Now, if you have noticed that your loan accounts are not updated properly or any incorrect information is mentioned, then you can rectify all those by raising the problem to the Equifax credit bureau.

Pingback: How to write a complaint letter in Equifax?