Is your loan application is rejected? From the lender, you came to know that you have delinquencies in your Equifax credit report. And, the lender advised you to rectify those delinquencies, after that only they can approve the loan. Now, you are searching for the possible ways to rectify your Equifax Credit report.

But, like in other credit bureaus (TransUnion CIBIL, Experian, CRIF Highmark); there is no option presents in Equifax so that you can raise an online dispute to rectify your credit report. The one and only way to raise your concern to Equifax is sending a complaint letter though email. Here, we have mention those important email address, by which you can approach to Equifax.

Different levels of email id’s to send complaint letter in Equifax:

Level 1:

Through there are different levels are present, but if you are sending your concern for the first time in Equifax, then should mail the complaint letter to Level 1 customer care as mentioned in the below.

Email id- [email protected]

Ph- 1-800-209-3247

Level 2:

To resolve your problem, Equifax will take 30 days as TAT (Turn Around Time). If you did not receive any kind of response within 30 days or the dispute resolution did not match your expectation, then you need to forward your complain to Equifax’s Nodal Officer.

Nodal Officer’s email id-

- [email protected] (Contact Person – Yashpal Deora)

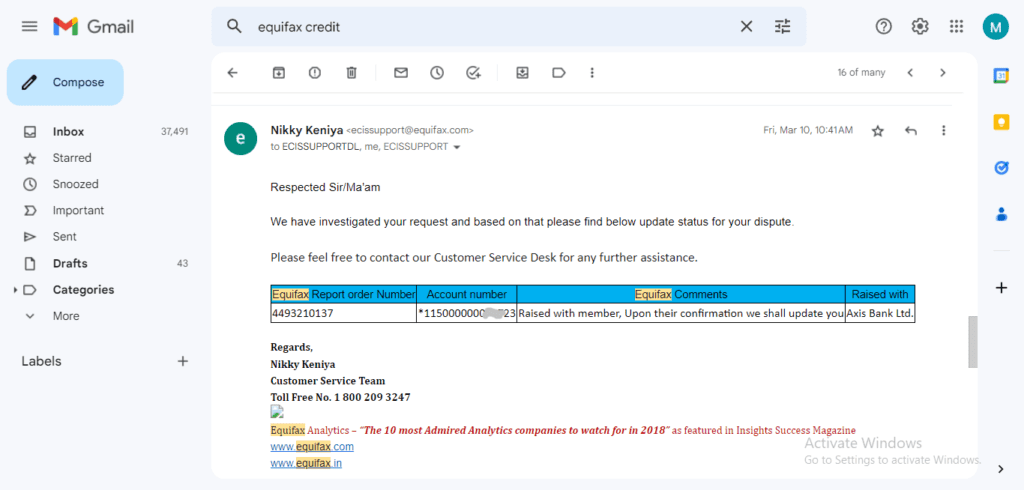

- [email protected] (Contact Person – Nikky Kenya)

They will investigate the whole matter priority basis to solve the issue. If you have any reply or service request number received from Equifax Customer Care, then you should mention those in this letter to get higher priority.

Level 3:

If your concern is still not addressed by Nodal officers within 7 days, then you should convey the problem to Principal Nodal officer’s email as mentioned in the below.

Principal Nodal Officer’s Email Id- [email protected] ( Contact Person- Museb Shaikh)

How to write the complaint letter:

In the complaint letter, you have to describe your concern elaborately and attached supporting documents like KYC, Payment Details, and NOC (If needed) with that. And, don’t forget to mention Equifax ERN Number in the letter; because they will retrieve our credit report from their end for cross verification.

Sample letter format:

Dear Sir /Madam,

I am Mitali Dey, staying at 25/3, Baharampur, Murshidabad, West Bengal 742XXX. My DOB is 18/04/19XX. My PAN card number is APDPXXXXXX, and my Aadhar card number is 5835 7391 XXXX.

After reviewing, I found a “Charge off/Written-off” status showing one of my AXIS BANK Credit Cards (A/C – 1150000000XXXXX) in my EQUIFAX credit report. The primary card number is 41114606022XXXXX. My EQUIFAX ERN number is 2023021597148793.

The details of the following loan account are –

Member A/C Number High Credit Sa. Date Overdue

AXIS BANK ####4543 4210 05/04/2021 0

The shown “Charge off/Written-off” status was incorrectly reported to EQUIFAX. I cleared all the outstanding amounts and closed this loan last year. This account has zero overdue remaining unpaid.

So, I request you kindly remove this “Charge off/Written-off” status from my EQUIFAX credit report as early as possible.

I am sending the attachments with the necessary KYC documents and the NOC; kindly find them below and do the needful.

Thanks & Regard

Mitali Dey

Mob – 9876543210

Sample replies from Equifax:

Read more:

Pingback: How to get a free Equifax credit report?