What is a commercial CIBIl report? Like an individual CIBIL report, a commercial CIBIL report highlights the creditworthiness of a company or business. It is commonly known as the Company CIBIl report.

The primary difference is that an individual CIBIL report generates a CIBIL score, but a commercial CIBIL report generates a CIBIL rank. A commercial CIBIL report is considered a comprehensive statement. It represents the financial health of an organization.

TransUnion CIBIL prepares these reports for the commercial borrowers, such as private limited companies and public limited companies. This report will determine a company’s creditworthiness if they require a commercial loan.

How to read a commercial CIBIl report?

Reading a commercial CIBIL report is not a very difficult job. When you have your company CIBIL report in your hand, you need to follow the below steps.

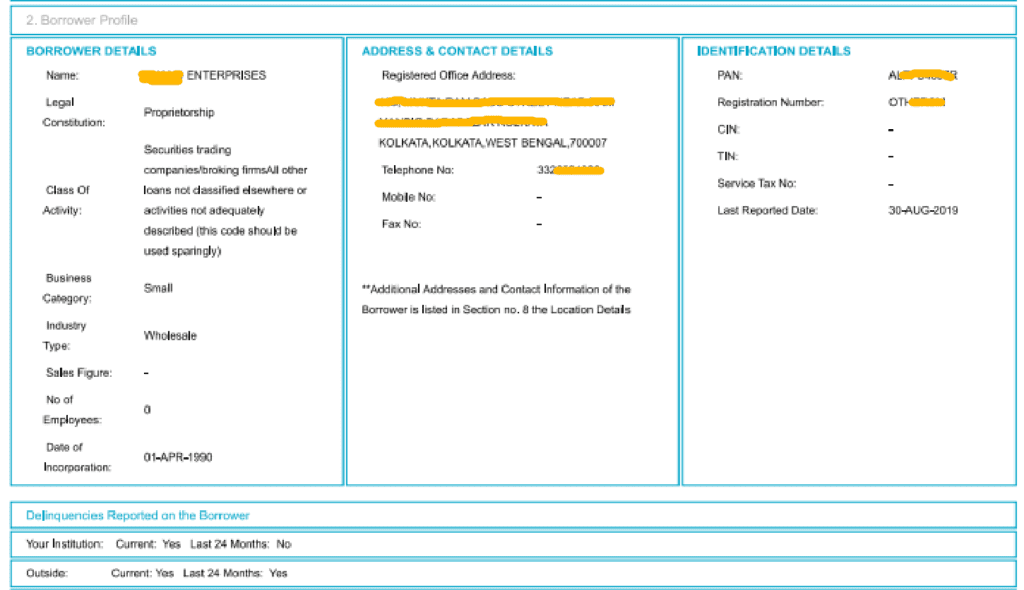

2) Borrower Profile – In this section, you can find your demographic information such as

Borrowers’ Details, Address and Contact details, Identification Details, and Delinquencies Reports.

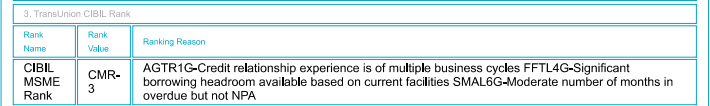

3) TransUnion CIBIL Rank – The most vital thing in your Commercial CIBIL report is the CIBIL Rank. It is a number ranging between 1 up to 10. It is good if your rank is “1” or a closer number of “1”. Most of the banks offer loans if your CIBIL rank is below 4.

Sometimes, you may find NA instead of any number because; the TransUnion CIBIL cannot generate a credit rank of your company. Before applying the report, you should be aware of your CCR as the CIBIL rank is generated only for companies who have taken loans between Rs. 10 Lakh to 50 Cr.

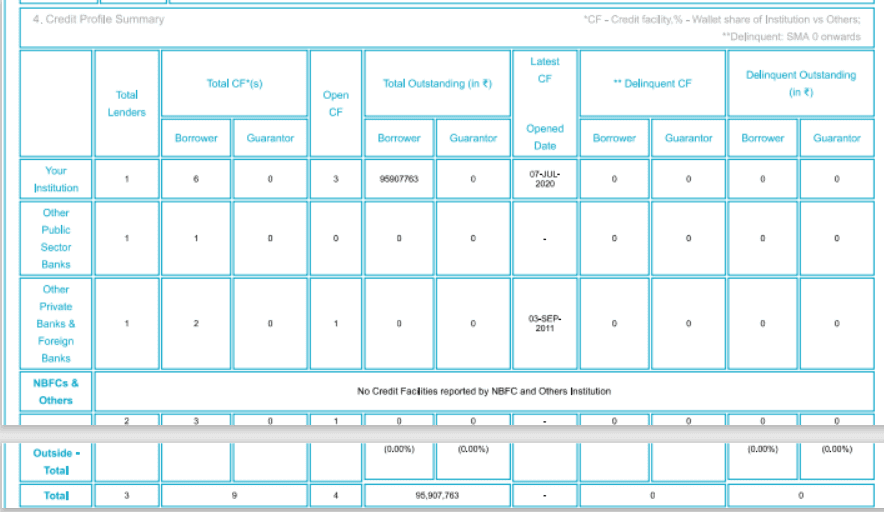

4) Credit Profile Summary – Here, you can find your company’s credit history. How many loan facilities are taken can be seen here. It includes active account as well as closed account details. Here, you can also find the repayment status, payment delay.

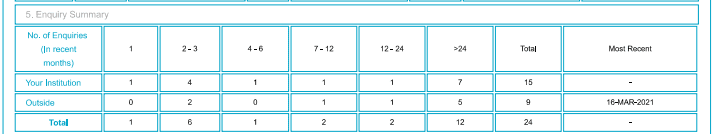

5) Enquiry Summary – This section indicates how many times bankers have enquired about your company in the last 24 months.

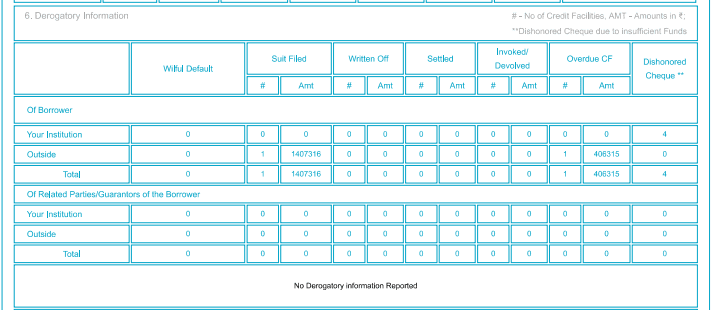

6) Derogatory Information – This is the most crucial part of your commercial CIBIL report where your bankers have their eyes. This section provides information on whether any filed lawsuits, willful defaults, write-offs are associated with your company or not.

Naskar Financial Services is a reputed Credit Score Repair Agency in Kolkata. We help to improve Credit health of Company Credit Report and boost CIBIL Rank of the company. We provide services to all over India.

Chife Consultant

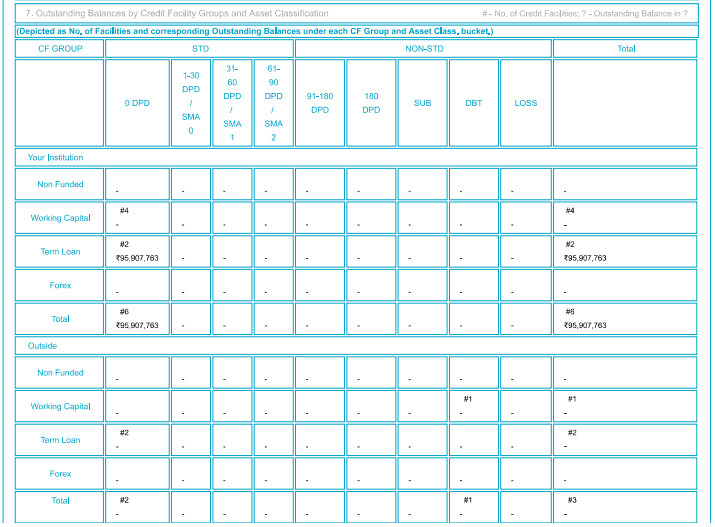

7) Outstanding Balances by Credit Facility Groups and Asset Classification – This part of the report gives you information about the Working Capital, Non-fund, Term Loan, and Forex of your company.

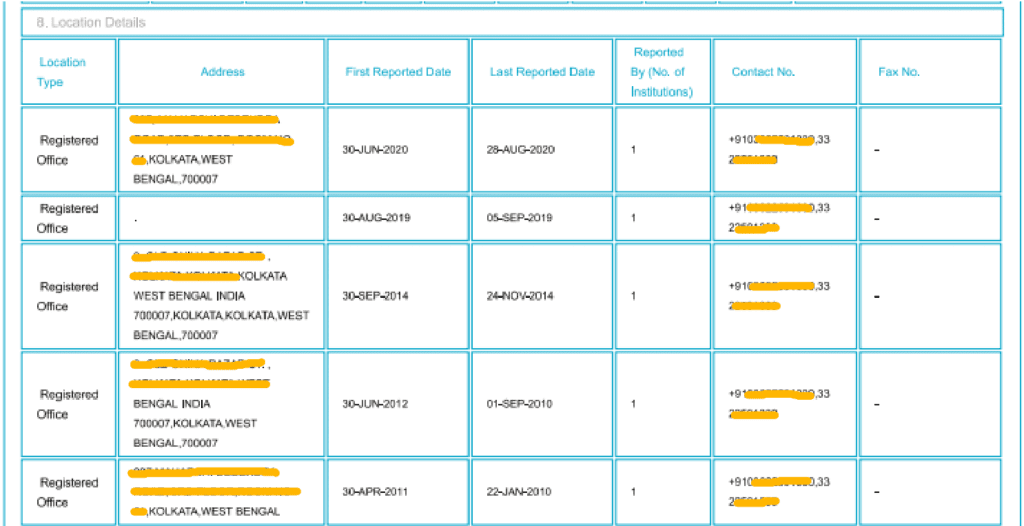

8) Location Details – All the locations and addresses associated with the company are listed here with the submitted contact numbers.

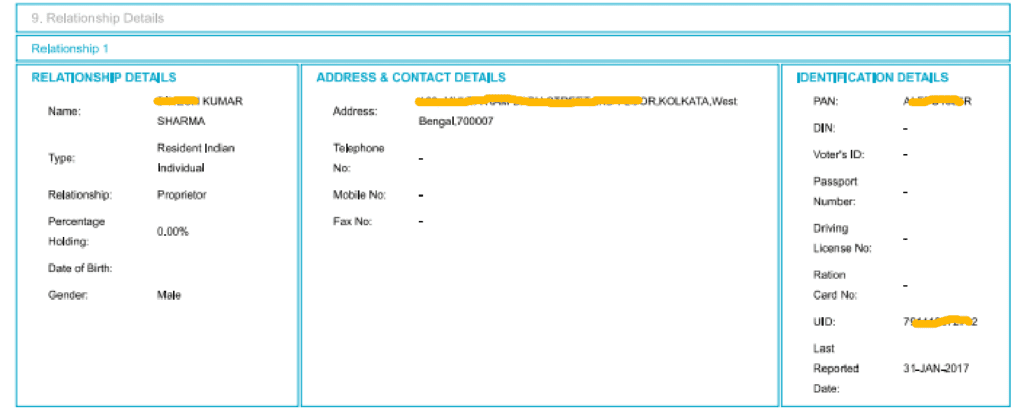

9) Relationship Details – In this area, you will get information related to guarantors. It includes the name, type, percentage holding, address, contact details, PAN, and UID number of the guarantors.

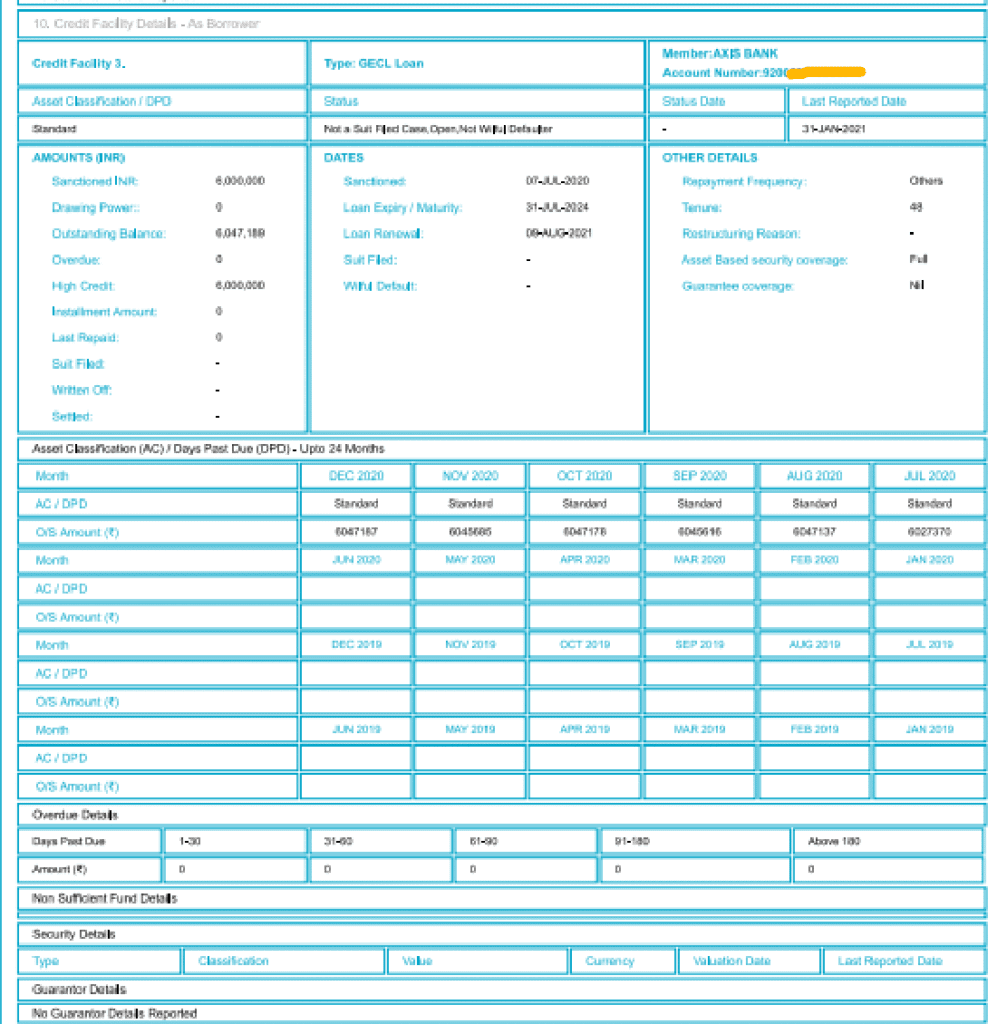

10) Credit facility details as Borrower – Here, you will find all the information about each credit facility your company has taken. You can also find all information about where your company provided the guarantee to other companies.

11) Credit Facility Details as Guarantor – In this part, you can get all the information about other companies where your company has provided financial guarantee. Here, you will easily find the name, addresses, and contact details of those other companies.

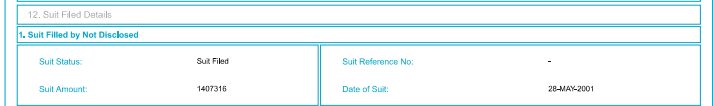

12) Suit Filed Details – All lawsuits filed against your company will show here if your lender reports to TransUnion CIBIL. It will help to take an overview of legal matters at a single glance.

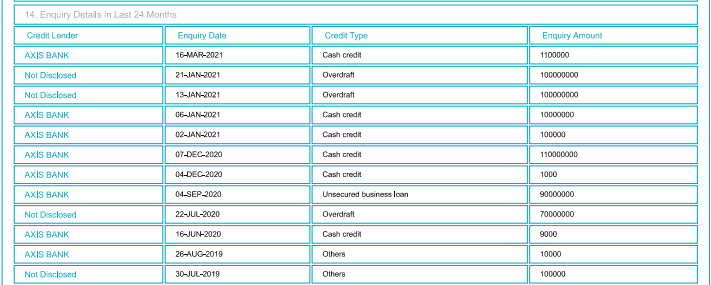

14) Enquiries Details in Last 24 Months – In this part of the report, you can see all the loan inquiries details of your company within the last 24 months.

How to rectify commercial CIBIL – step by step process

Rectifying a commercial CIBIL report is very easy for those with a basic understanding of the financial sector. To repair a company CIBIl report, you need to follow a few steps such as dispute creation, email sending, etc.

# Method 01

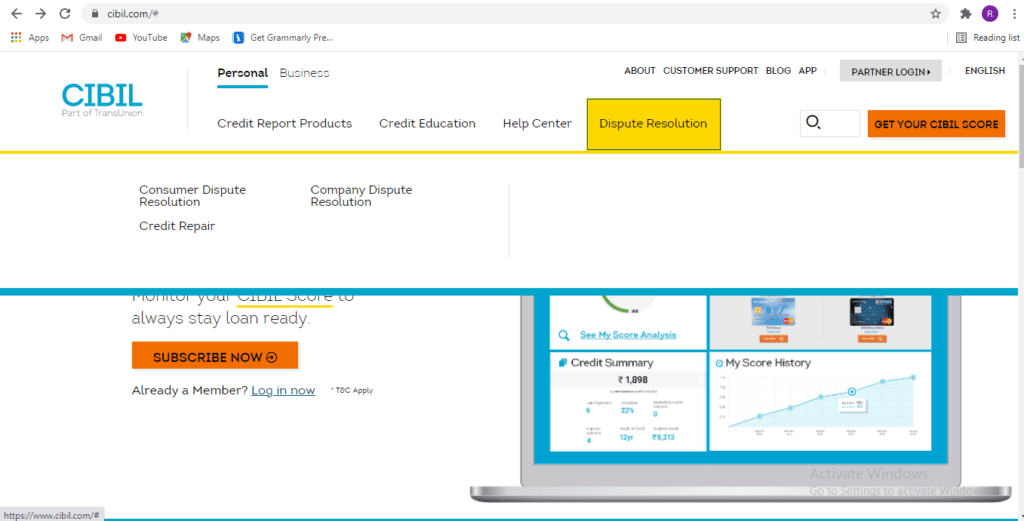

Dispute creation – To create an online dispute, the first thing you have to do is open the official website of TransUnion CIBIL in your preferred web browser. At the top header section, you need to click on the Dispute Resolution option.

After clicking this, a sub-navigation bar will appear with three options. Select and click the Company Dispute Resolution option among three of them.

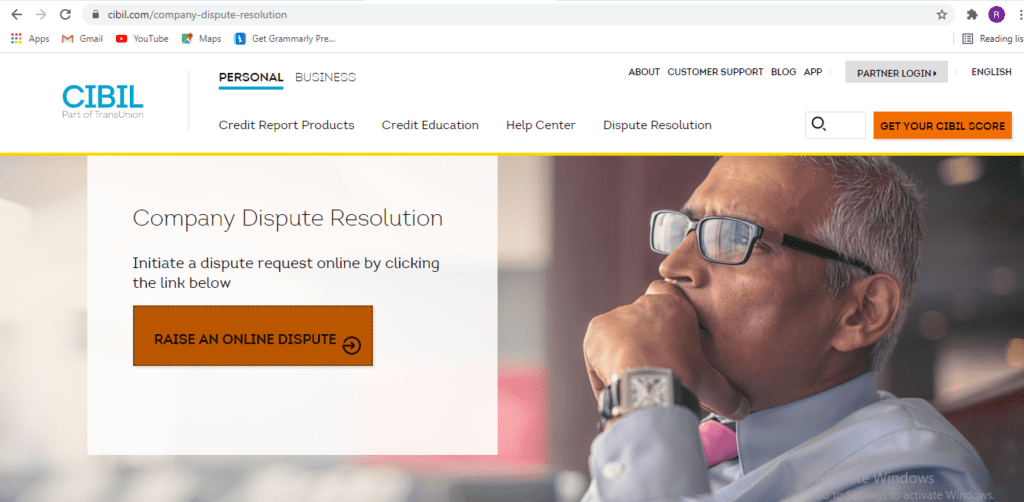

Then, a giant button called Raise An Online Dispute will appear in the middle of the landing page.

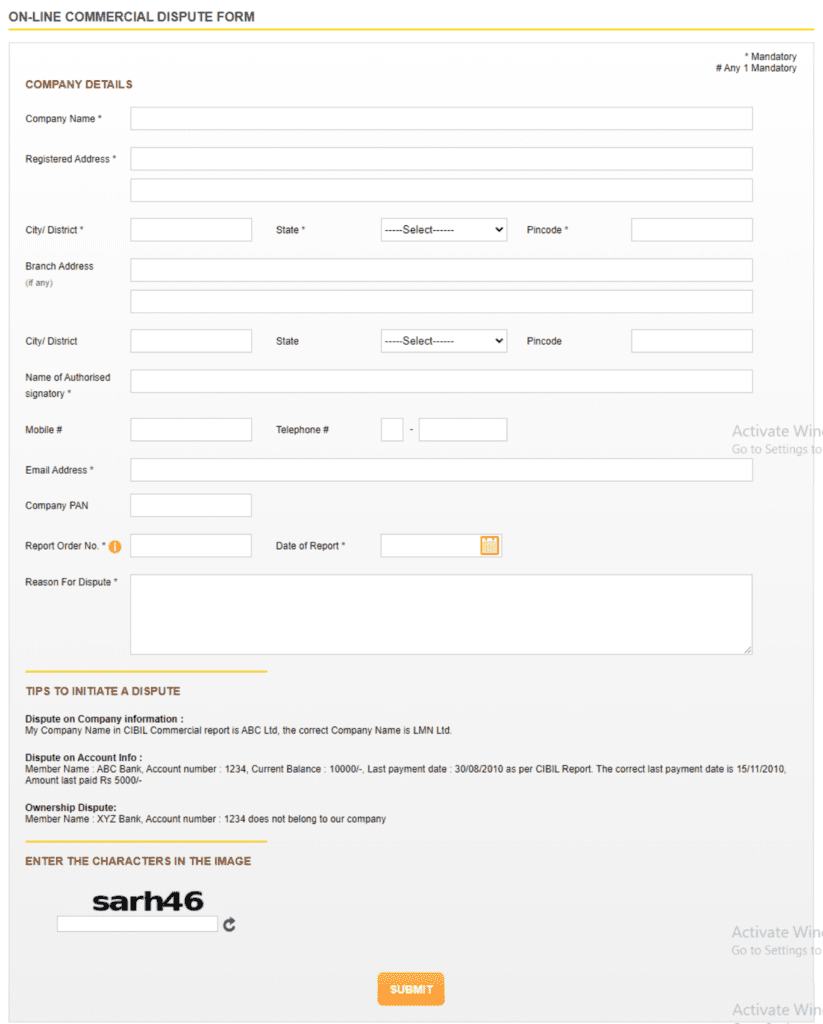

Just click on this button, and an ONLINE COMMERCIAL DISPUTE FORM will appear in a new tab.

Fill up the form with all necessary details like Company Name, Address, Company PAN, Report Order No, etc. At the bottom of the form, you will find a text field Reason For Dispute *, where you need to describe the errors that you want to rectify in your commercial CIBIL report.

Luckily you may get some basic tips below in this text field. After that, fill in the Image Captcha, then click the submit button. If everything goes perfectly, a reference number will pop up on the next page and save it.

Now you need to check your email frequently to follow up on the response

from CIBIL.

# Method 02:

Email Sending – Sometimes, creating a dispute may not rectify or fix your problems. In that scenario, you may go one step further by sending emails to the member bank or NBFC and CIBIL.

You need to write an email that starts with all the essential information about your company including company address, PAN number, etc. Then describe your problem and mention the Report Order Number in the email.

After that, you have to find the customer helpline email addresses of the member bank or NBFC company on the internet. Now, send the email to those email addresses, and don’t forget to tag or CC the email to TransUnion CIBIL official email address cibilinfo@transunion.com.

Before sending the email, make sure to send the scanned copy of all KYC-related documents of your company and a copy of your company’s CIBIL report. Also, send a screenshot and highlight the area of the errors. Like dispute creation, you also need to check your email frequently for any updates.

# Method 03:

You can send letter to Transunion CIBIL office for rectify the Company Credit Report. Transunion CIBIL office address:

TransUnion CIBIL Limited

(Formerly: Credit Information Bureau (India) Limited)

One World Centre, Tower 2A, 19th Floor,

Senapati Bapat Marg, Elphinstone Road,

Mumbai – 400 013.

You may contact them directly.

Consumer Helpline Number: +91 – 22 – 6140 4300

Timings [Mon – Fri]: 10:00 AM to 06:00 PM

Board Line Telephone: +91 – 22 – 6638 4600

A few common errors in Company Credit Report:

Sometimes, a company credit report comes with many errors or inaccurate information. These errors may include identity-related misinformation, data mismatch errors, payment-related errors, and account ownership-related issues, etc. A few common errors in a Company credit report are:

Identity errors –

● inaccurate information printed in your identity section like incorrect name, phone number, address, etc.

● Another person’s account displayed in your report that doesn’t belong to you.

Inaccurate account information –

● Incorrect date of opening, last payment date reported in your report.

● Inaccurate account overdue, current balance displayed in the report.

● A closed account is still showing open.

Data Mismatch errors –

● Accounts may appear multiple times in a report.

● Incorrect information may appear again after it is corrected.

CIBIL score (CIBIL rank) repair agency:

Repairing your commercial credit report is not very easy; instead, it is a complicated job. You can do it yourself if you know the right way. If you don’t know the right way, you need an expert who does it professionally.

Then, the CIBIL score (CIBIL Rank) repair agency comes into the picture. This type of agency can help you to remove incorrect information from your company’s CIBIL report, which can help to improve your CIBIL rank.

Naskar Financial Services is an one of the best Loan Consultant as well as Credit Consultant in Kolkata. We have experience more than 15 years in Banking and Finance sector and more than 5 years in Credit Health Improvement Services. Contact us for your Company’s Credit Health Improvement.

Read More:

- CIBIL Score repair agency

- How to improve CIBIL Score form 550 to 750

- How to rectify individual CIBIL report

- How to get Commercial CIBIL report (CCR) and check CIBIL Rank

Pingback: What is the difference between CIBIL Rank and CIBIL Score?

Pingback: How to improve the CIBIL score immediately?