Is your loan application rejected due to any inaccuracy in your CRIF Highmark (CHM) credit report? And are you facing any difficulty to rectify CRIF Highmark Credit report? Since CRIF Highmark is one of the leading & comprehensive credit information bureaus in India, the lender may check your CHM credit report before approval of your loan/ credit card application. So, it is very necessary to maintain the correctness of all of the mentioned information.

If your loan repayments are not updated regularly, then delinquency (Overdue, Written-off, Suit Filed, DPDS) can be shown in your CHM credit report. As a result, your CHM credit score will go down and the possibility of loan approval will be less.

For that reason, you should check your CRIF credit report and be aware of whether your loan repayments are updated regularly or not. If there is a default account shown, then you should raise your concern problem to CRIF Highmark for rectification.

Methods to rectify CRIF Highmark credit report:

There are two main steps by following that you can rectify the incorrect information in your CHM credit report.

A. Raise a dispute online through the CRIF Highmark portal.

B. Send a complaint letter through email.

In this article, we have elaborated both ways, step by step with practical demonstration. Here, we have hided some confidential information for security reasons.

A. Raise a dispute online through CRIF Highmark portal:

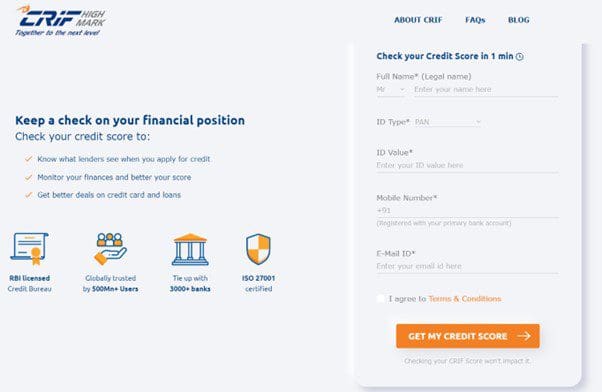

- First you need to visit CRIF Highmark free credit report: https://cir.crifhighmark.com/free-credit-report/freeflow Now, log in to your CRIF portal by filling out this form and OTP verification.

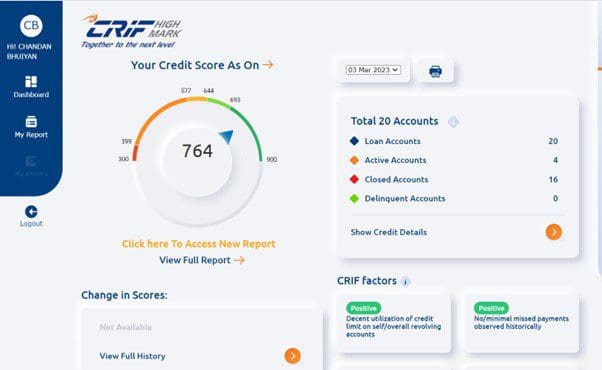

2. Then your CRIF portal will open to you as shown in the picture below. There are two sections are present in your CRIF portal. One is “Dashboard” & the other is “My Report”. Now go to the “MY Report” section.

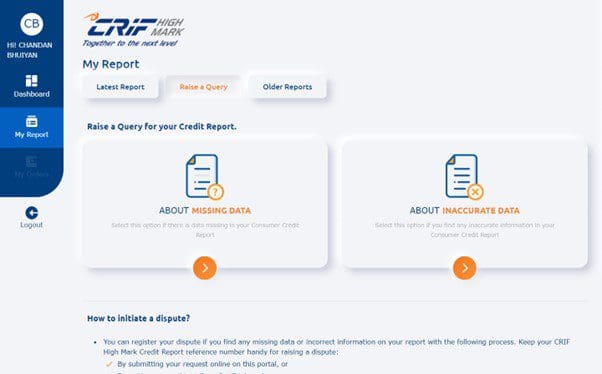

- After that a page will open as in picture below. Under the My Report section, there are another three segments. i) Latest Report ii) Raise a Query iii) Older reports

To raise a dispute online, you have to click on the “Raise a Query”.

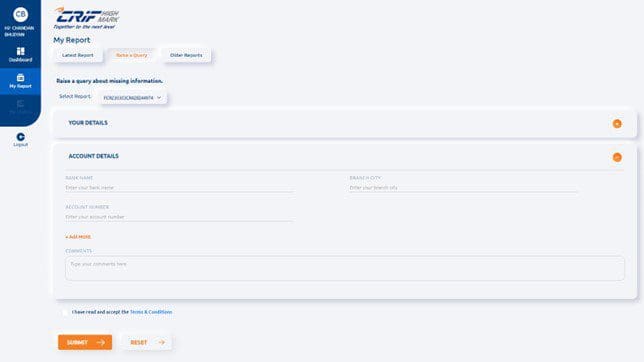

4. Then the dispute page will open to you as mentioned in the Picture below. To rectify CRIF Highmark credit report, you can raise your concern query for two cases.

i) ABOUT MISSING DATA: If any of your current loan accounts is absent in your latest CRIF Highmark credit report, then you can update the account by raising a dispute under this section.

ii) ABOUT INACCURATE DATA: If there are any inaccurate data in the different section of your CHM credit report like Personal details, Contact Details, KYC details, Account Details & Inquiry History Details. In that case, you have to raise the dispute in this particular section.

i. Dispute for MISING data:

First, you need to select your current report number, where the loan account is missing. Then put the account details like Bank name, account number, and Branch city. In addition to that, you can add some comments like account type, sanctioned date, sanctioned amount, etc. then click on “SUBMIT”.

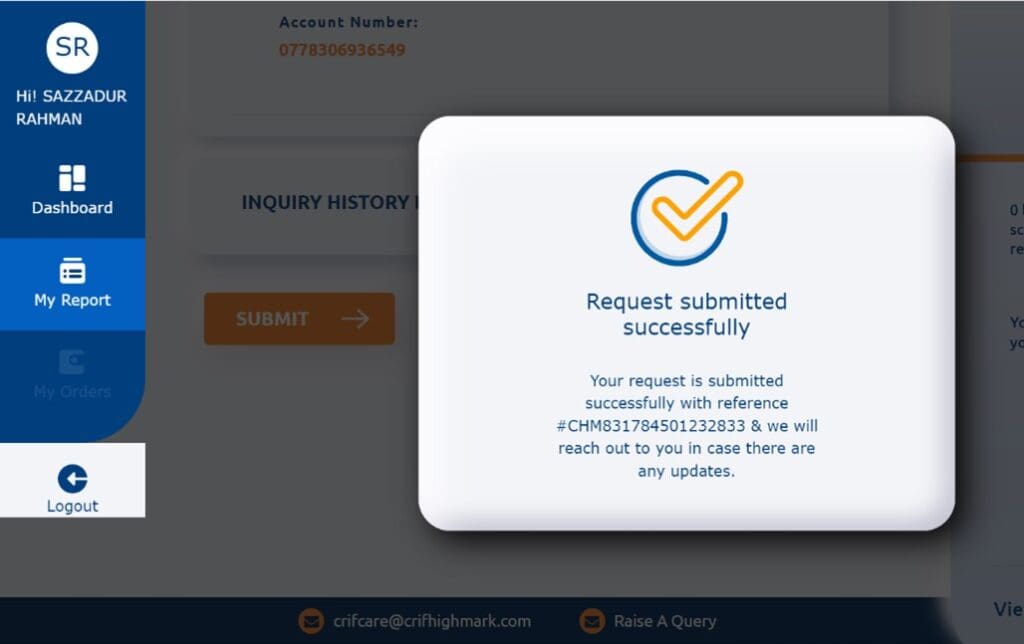

After that, a service request number will generate (starting with #CHM…), which one is important for further process.

Be noted, here you can raise a dispute for more than one missing account by “Add more” option.

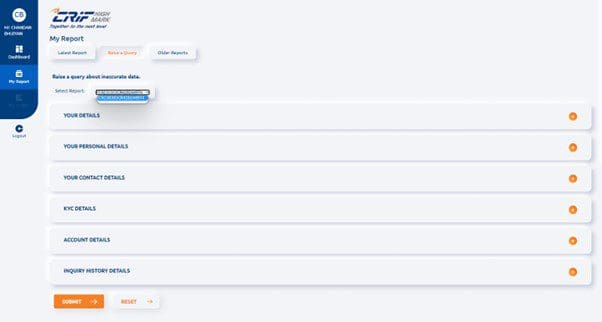

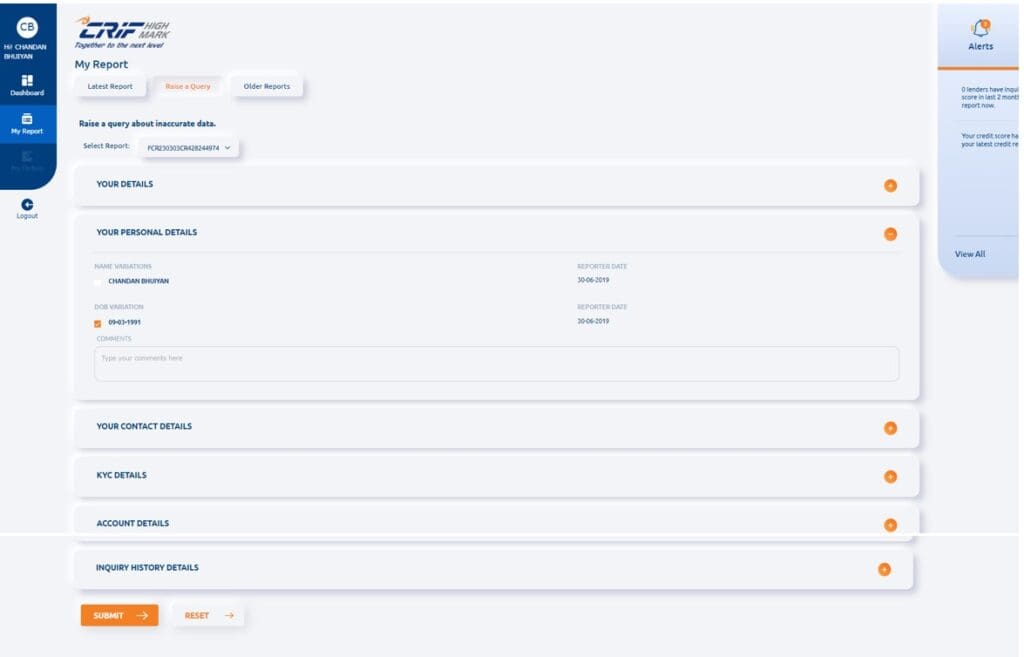

ii. Dispute for inaccurate data:

There are several sections in your CRIF Highmark report, it contains Information like Personal Details, Contact Details, KYC Details, Account Details, Inquiry History Details, etc. So, you can raise a dispute for the incorrect information present in any of these sections.

For example, your Date of Birth is incorrect in the CHM report. First, need to select the CHM report number as mentioned in the picture above. Then click on “YOUR PERSONAL DETAILS”, where you can see that your Name & DOB are mentioned as shown in the picture below.

Select the box beside your DOB then a comment box will open. In that box, you can write your correct DOB in this manner “My correct Date of Birth as in my KYC documents is DD-MM-YYYY. So, kindly update that in my CRIF Highmark credit report”. Then click on submit.

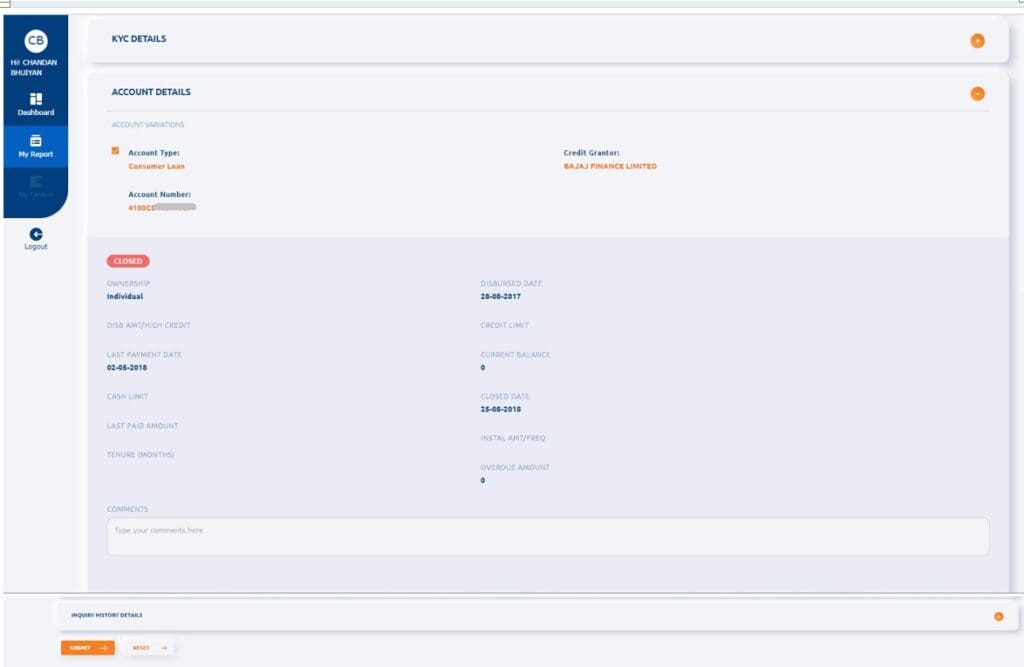

For another example, if you closed a loan account and collected the NOC from the bank. But that particular account is mentioned as an active account with some default in your CHM credit report. In that case, similarly, first select the CRIF report number and then click on the “ACCOUNT DETAILS” section. Here, all of your loan accounts are mentioned.

Select the check box mentioned beside the account, and all details regarding this loan account will be open to you (like Account status- Closed/ Active, Ownership, Reported Date, Last payment Date, Current balance & Overdue amount, etc.).

In the comment box, you can write as “I have closed the account on the date DD-MM-YYYY. So, update that as a closed account in my CRIF Highmark credit report.”

To submit the dispute, click on the “SUBMIT” button. Similarly, after a successful submission, a Service Request Number will generate.

This is how you can raise a dispute online to rectify CRIF Highmark credit report. kindly note that this service request number is very crucial for further communication, so remember to save that.

B. Write a complaint letter in CRIF Highmark:

Be noted, only the online dispute method is not sufficient to rectify the CRIF Highmark credit report. As per the guideline, CRIF Highmark has no authorization to change any of the disputed information by itself. Your disputed details will forward to the concerned lending institute. The information will be modified only after getting confirmation from lenders.

Since in the online dispute methods, you can’t attach the supporting documents, so there is a major possibility that the dispute resolution will take more time or remain unchanged. For those reasons, you can send a complaint letter via email with evidence to rectify CRIF Highmark credit report.

There are different level email id:

Level 1:

For individual customers: crifcare@crifhighmark.com

For Commercial customers: customerservice@crifhighmark.com

Customer care contact number: 020-6715-7709/742/776 /771/779/780 (09:00 – 18:00 Monday – Friday)

Level 2:

Nodal officer: nodalofficer@crifhighmark.com

Contact Number: 020-6715-7777 (09:00 – 18:00 Monday – Friday)

Level 3:

Principle Nodal Officer: Principalnodalofficer@crifhighmark.com

Contact Number: 8291335432 (09:00 – 18:00 Monday – Friday)

In the complaint letter, you have to mention your CHM report number. Here, you can describe the problem elaborately and attach the report and other relevant documents. And send the email to the Level 1 email id.

If you do not get any response or proper resolution from them, then forward that email to higher levels (Levels 2 & 3) and call on the Customer Care Helpline number with your Dispute Service Request Number. You also receive updates from CRIF Highmark on your email id, you have to follow those to take needful steps.

In addition to that, you can contact the concerned credit institute for a faster solution. We expect by following all of these ways, you can rectify the CRIF Highmark Credit report smoothly.