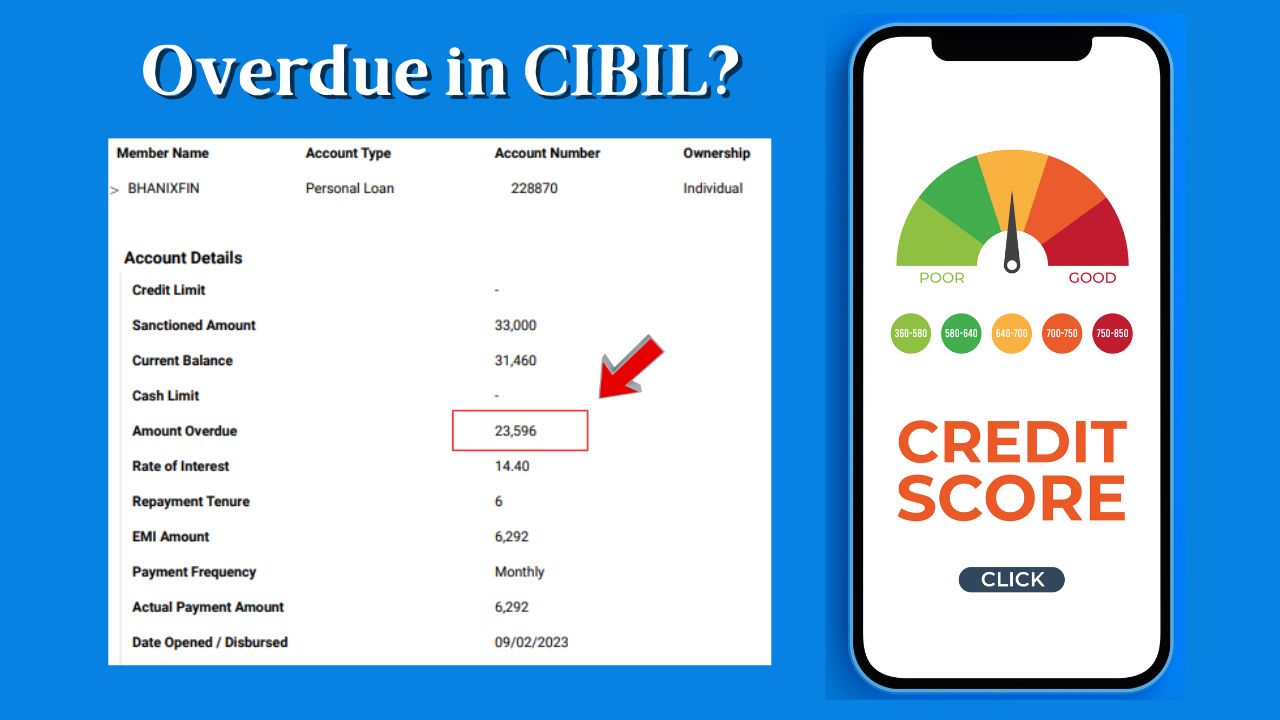

At first, an individual should understand what an Overdue in CIBIL means. Overdue is a minimum due amount billed in the previous loan statement and has remained unpaid, wholly or partially. Overdue is to be cleared immediately by paying all the unpaid loan EMIs and credit card dues in time or before the due date. Here we will discuss how to remove overdue from CIBIL report.

It is very important that you make sure that you have a spotless repayment record. Making full payments on time will have an immediate positive impact on your credit score.

Now, overdue has to be removed immediately from the CIBIL report because it can have a negative impact on a borrower’s credit score and can make it more difficult to obtain a loan in the future. It is important to make all of your payments on time to avoid damaging your credit score.

Reasons behind an overdue in your CIBIL report:

- Overdue are reported to the credit bureaus by the Financial Institution (FI). Financial Institutions submit this information when you have an unpaid outstanding or EMI with them on a credit card or a loan. They usually submit this information in batches at the same time every month. If you missed your Loan EMI’s or credit card bills, the concerned financial institute will report an overdue amount (Due amount + Penal charges/ bounce charges) in your CIBIL report.

- Secondly due to irregular payment for a long time, the bank can report a Written-Off status in your loan accounts along with an overdue.

- Sometimes, the customer did not pay the due amount intentionally & the lender filed a legal case against the customer to recover the debt. In that case, an overdue can be seen with a Suit Filed status.

- In some cases, though you have paid the overdue amount, but because of the lender’s negligence, they did not update the repayments in your CIBIL report. As a result, the loan account became delinquent with an overdue amount.

- An overdue amount can be seen in a closed/ settled loan account. Since you have closed the loan, the overdue should not be there.

- Last but not least, an unknown default loan can be reported in your CIBIL report which may contain an overdue. In that case, you can remove the loan from your CIBIL report.

These all are the possible reasons for which an overdue can be mentioned in your CIBIL report. Now, you can remove overdue from CIBIL report by following a few steps. Here, we have tried to explain those steps in detail with practical examples.

Steps to be followed to remove an Overdue from the CIBIL report:

1. Pay the overdue amount

If you have some overdue amount in your loan account & you have not paid the amount yet, then first, you have to contact the concerned lender & pay the overdue amount. After payment, you can collect the No Dues Certificates/ the loan account statement for the CIBIL rectification process.

2. Remove an overdue by raising an online dispute in CIBIL

Once you paid the overdue amount, you should raise an online dispute in TransUnion CIBIL to remove the overdue from your credit report.

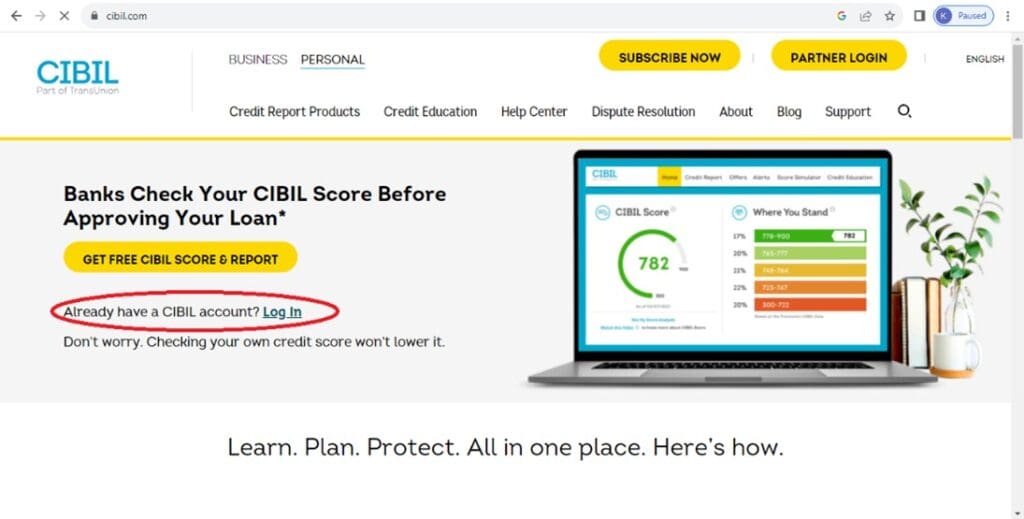

i. At first go to the official website of CIBIL, cibil.com On the TransUnion CIBIL dashboard, you can find the option “Log in” as highlighted in the picture below. Click on the link.

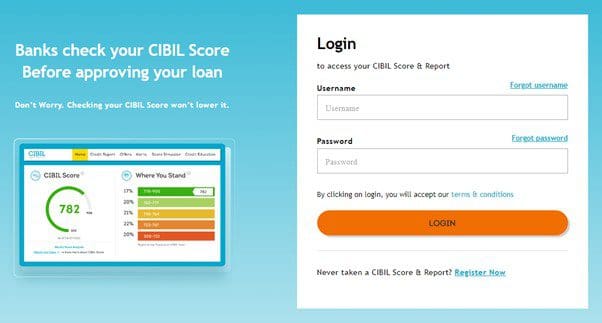

ii. A new Login page will be open to you as shown in the picture below. Here, put your CIBIL User name (Email ID which one you have used at the time of registration) & password. And, then click on “LOGIN”.

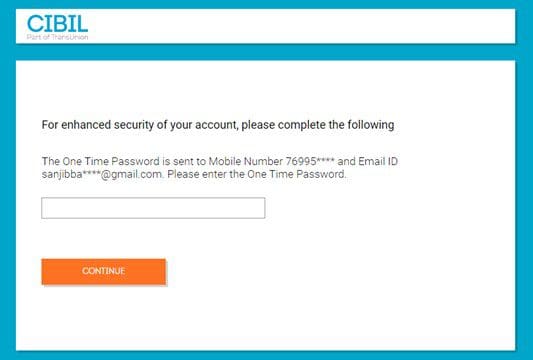

iii. An OTP will be sent to your respective email ID or phone number. Put the six-digit OTP in the given box and then continue.

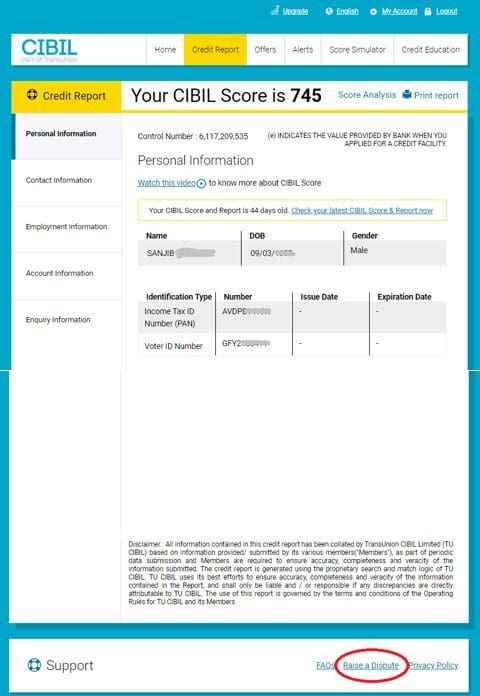

iv. After successful verification, you will reach to your TransUnion CIBIL portal. Now, go to the “Credit report” section. Then scroll down the page. At the bottom, you can find the option “Raise A Dispute” as highlighted in the below picture. To remove overdue from CIBIL report, you have to go for the “Raise A Dispute” option.

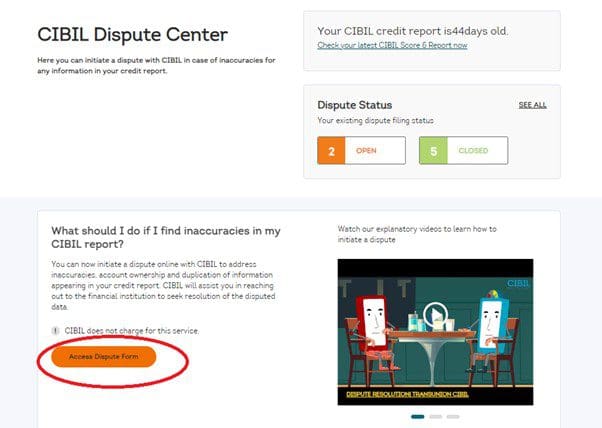

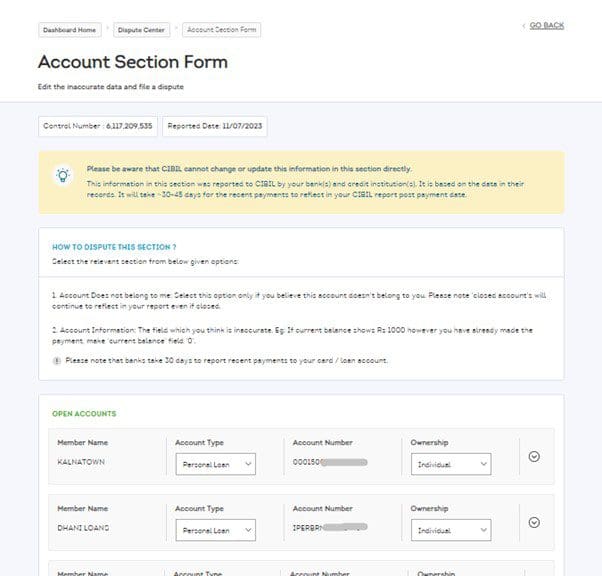

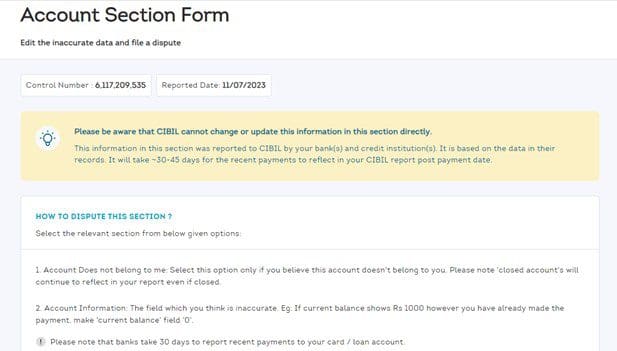

v. Then the CIBIL Dispute Center will open to you. On this page, you can find the bar “Access Dispute Form”. Click on that.

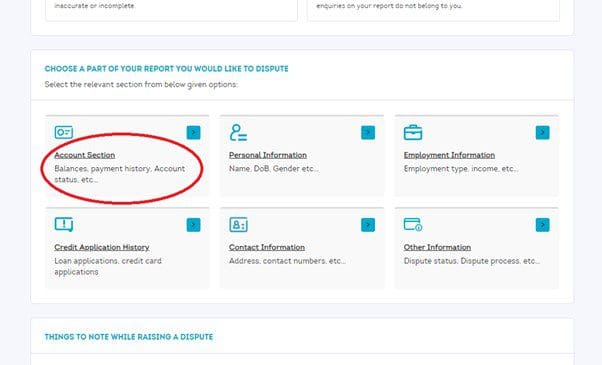

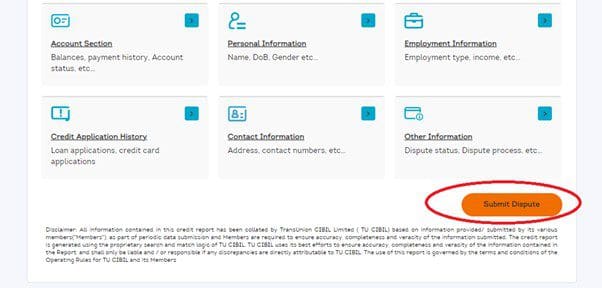

vi. You can raise an online dispute for each different section in your CIBIL report. Specifically, to remove overdue from CIBIL report, you have to select the Account Section option.

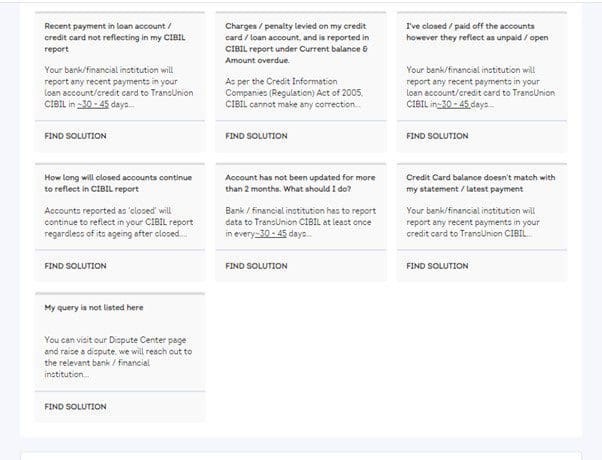

vii. On the next page, some possible reasons are mentioned for which you can raise a dispute in a particular account. Then select the most suitable option for you, and then click on the “FIND SOLUTION”

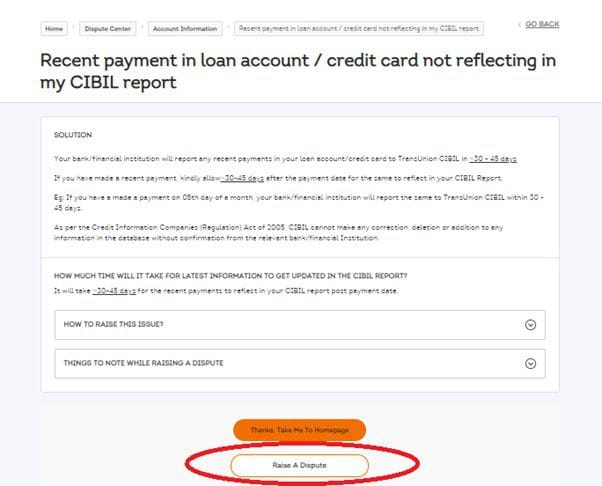

viii. On the new page, find the option for “Raise a Dispute” as highlighted in the below picture. Then click on the link.

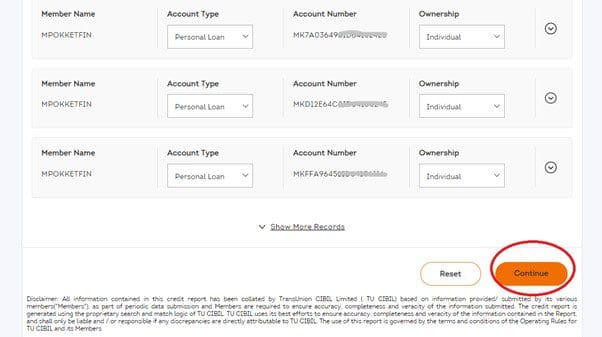

ix. Then the Account Section Form will be opened where you can find all your loan accounts listed serially. Now, select a particular loan account against which you want to raise a dispute. Here, we have discussed the further steps for each different case.

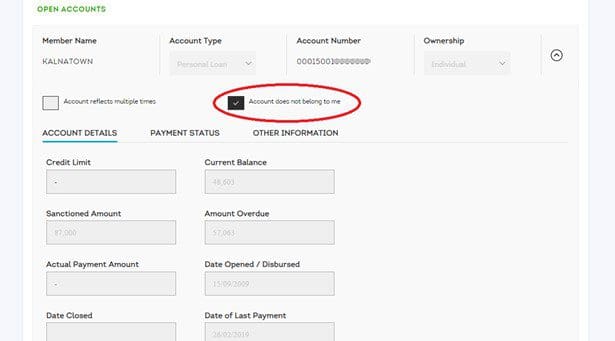

Case 1: If the default loan account is unknown to you

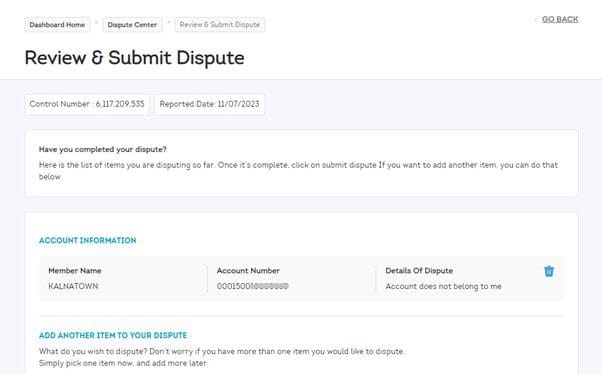

If the particular loan account which contains overdue is unknown to you, then you should raise a dispute by selecting the option “Account does not belong to me”. Select the check box as shown in the picture and then click on the “Continue” button.

Then the next page will open for you. After reviewing the disputed details, click on the “Submit Dispute” option.

After the successful submission of the disputed item, a dispute ID will be generated starting with CDS…Save the Dispute ID for the future purpose.

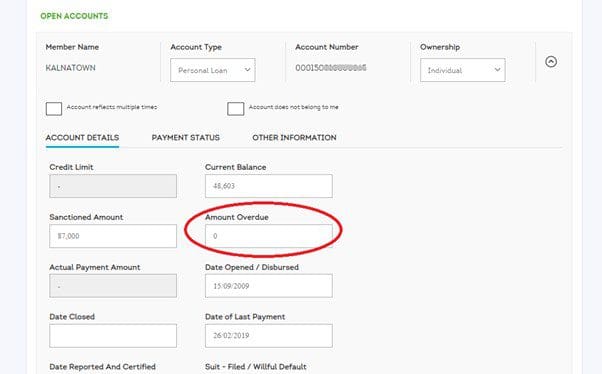

Case 2: If you paid only the Overdue Amount:

If your loan account is active now, and you have paid the overdue amount only; in that case, make the overdue amount zero and submit the dispute.

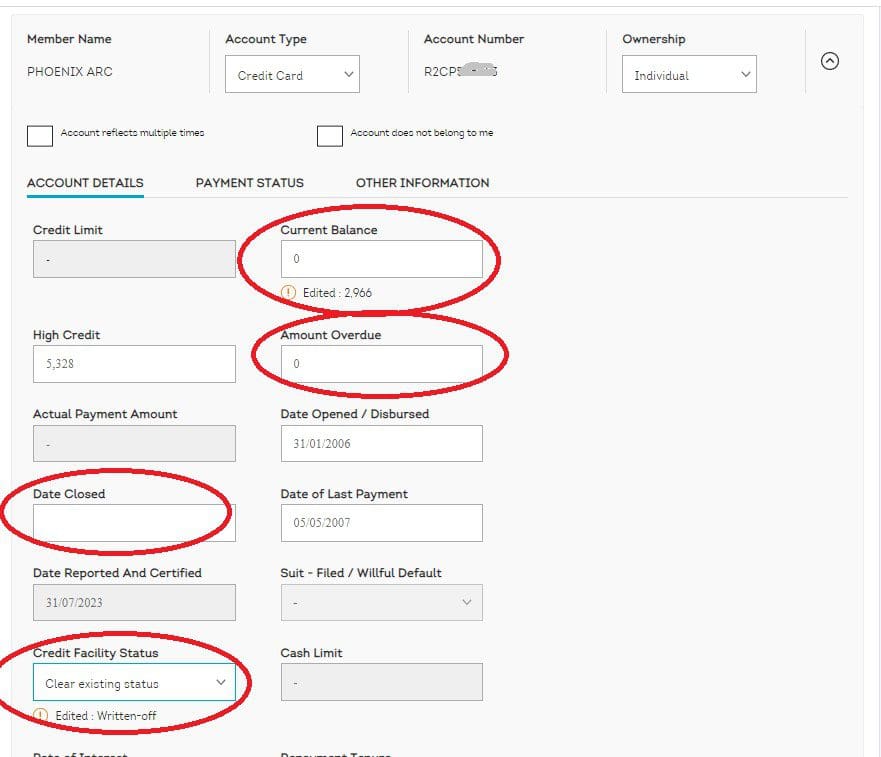

Case 3: If your account became Written-off; you cleared the entire due & closed the account:

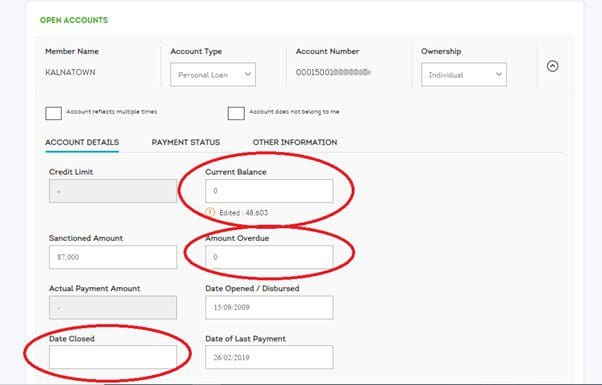

In case, your account became written-off due to non-payment. you have cleared the entire outstanding then make the Current Balance, Overdue ZERO & change the Written-of status to “Clear existing status ” as highlighted in the picture below. And, then submit the dispute similarly.

Case 4: If your loan is not updated properly:

If you have closed the loan by paying the entire outstanding, but the account is still showing as active with an overdue, then make the Current Balance & Overdue ZERO and mention the closing date. And, then submit the dispute.

3. Write a complaint letter to remove overdue from CIBIL report.

Sometimes, your problem remains unchanged even after raising an online dispute. In that case, to remove overdue from CIBIL report, you can send a complaint letter to CIBIL with the necessary supporting documents.

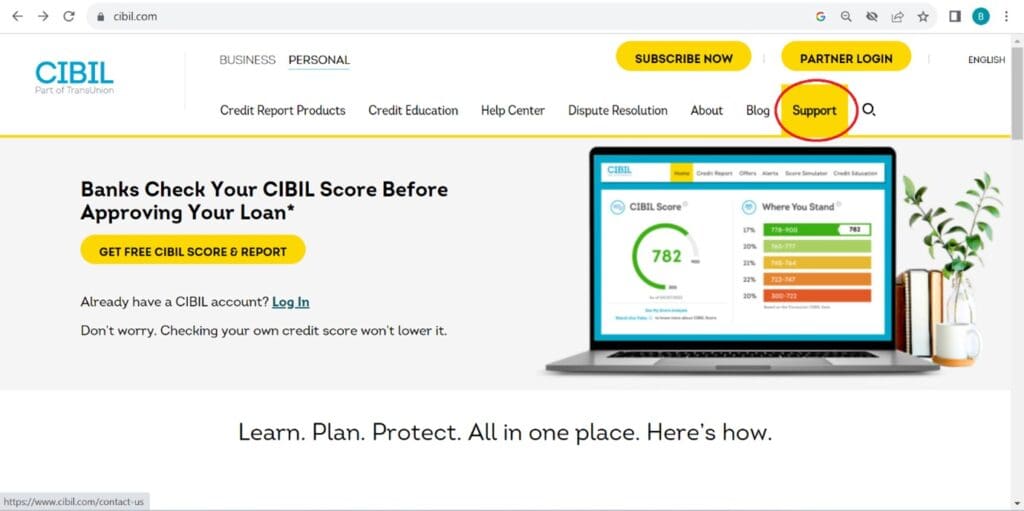

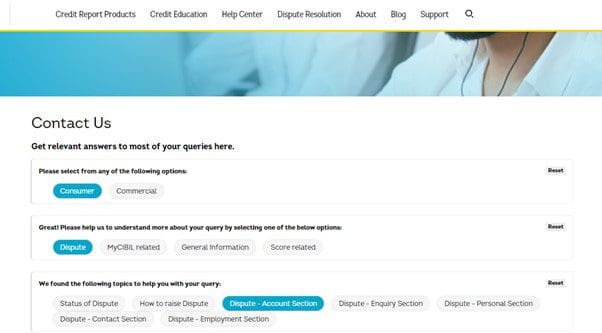

- First go to the CIBIL official website, cibil.com. On the home page, you can find the “Support” option. Click on that.

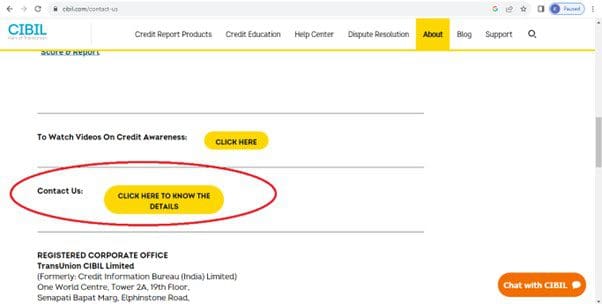

2. Then a new page will open to you. Then scroll down the page to navigate to the option “Contact Us: CLICK HERE TO KNOW THE DETAILS”. Click on the link.

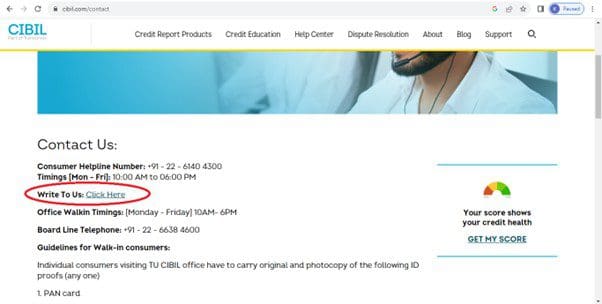

3. Then on the next Contact Us page, go for the option “Write To Us: Click Here” option.

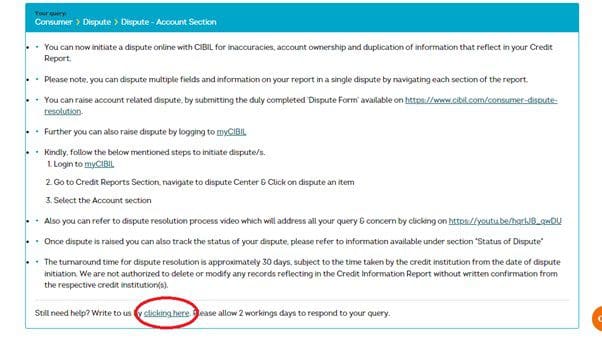

4. As you want to write a complaint to remove the overdue from your Individual CIBIL report, then select Consumer —> Dispute —> Dispute- Account Section. At the bottom of the page, you can find the option “Write to us by clicking here” as mentioned in the below picture. Click on the link.

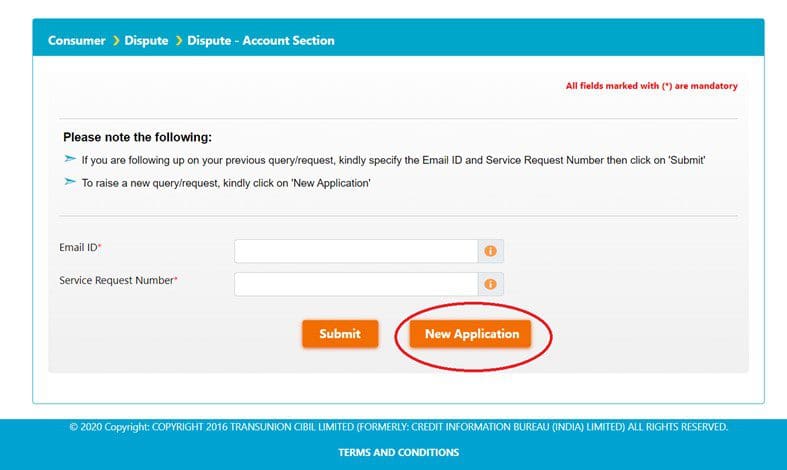

5. Now, if you are going to write a complaint letter for the first time, then select the option “New Application”.

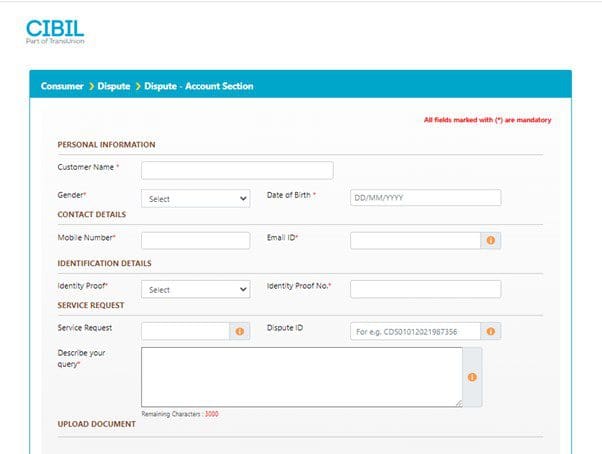

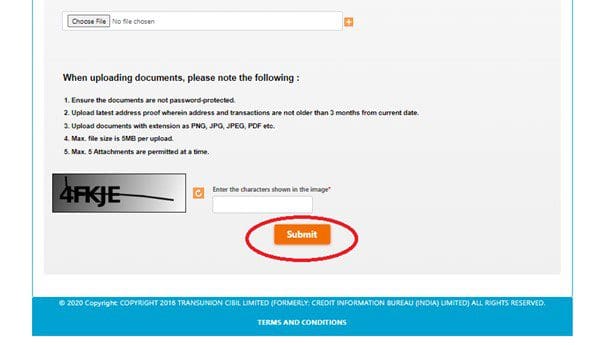

6. Now, a form will be opened, and you have to fill up the form with your Name, DOB, email ID, Phone number, PAN details, etc. Here, in the Describe your query box, you can write your problem in detail. Don’t forget to mention the CIBIL report control number (Mentioned on the first page top right corner of your credit report) in the complaint letter. Then upload your KYCs, latest CIBIL report, Payment documents, etc. At last, enter the captcha & then submit.

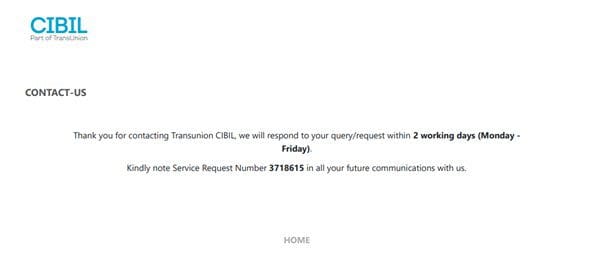

7. After successful submission, a Service Request Number will be generated as shown in the picture. Save the number for future use. This is the more effective approach to remove overdue from CIBIL report.

4. An email to the respective lenders can be sent to remove overdue from CIBIL report.

An individual can send an email to the respective lenders by writing in detail and attaching all necessary documents. The lenders will revert accordingly. This will help you to resolve your dispute as soon as possible. Once you have cleared your outstanding amount with the lender, you can expect the same to be reflected in your credit report at least after 30 to 45 days (the ideal time as stated by the Transunion CIBIL official website).

I hope the information is valuable to you. I hope, after following all these steps, you can able to remove overdue from CIBIL report & improve your CIBIL score accordingly.

Read more:

- How to remove “Settled” status from the CIBIL report?

- How to remove “Written off” status from CIBIL report?

(1) November 19 2021 yah band kar do

(2)November 11 2024 yah band kar do

(3) August 28 2024 yah band kar do

Mujhe dusra loan lena hai

Please get in touch with our helpline. Our helpline number is 9674755222 or 9088338222. Contact between 10 am to 8 pm from Monday to Saturday.

Yah teenon band karna hai