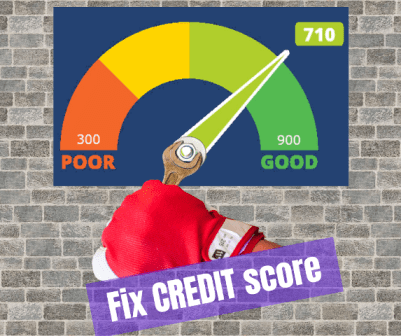

I hope the CIBIL score is not a new thing to you if you ever applied or inquired for a loan. Here, you can find 10 ways to improve CIBIL score. It is a 3-digit numeric summary based on your credit history with ranges between 300 to 900. A higher CIBIL score is considered suitable for getting a preferable loan; similarly, a lower CIBIL score may not acceptable for a preferable loan.

Suppose your CIBIL score is more than 750; you can surely get a loan from any bank or loan provider. On the other hand, if your CIBIL score is less than 750, you may face a little difficulty. But if your CIBIL score is below 650, then it isn’t easy to get a loan from any respective bank.

What is CIBIL?

CIBIL (Credit Information Bureau (India) Limited), now know as TransUnion CIBIL Limited is a Credit Bureau or Credit Information Company. This company is engaged in maintaining the records of all the credit-related activities of companies and individuals, including credit cards and loans.

Registered banks and several other financial institutions regularly submit their information to CIBIL. Based on these institutions’ data and records, CIBIL issues a CIR (Credit Information Report) and a credit score. It provides data to the banks and other lenders to quickly and efficiently filter the loan applications.

“Naskar Financial Services is the most trusted Finacial Consultant in Kolkata as per customers. We provide CIBIL score improvement services throughout India. You may contact us to improve your CIBIL score”

Reasons behind low CIBIL score?

There are several reasons behind a low CIBIL score, and all of them are depends on your credit history.

- Credit Card Due: If you do not pay your credit card due on time, your CIBIL score will be low.

- EMI Bounce: If you do not pay your EMI on time, your CIBIL score will go down.

- Too Many Inquiries: If you apply for a loan from many banks simultaneously, suppose your loan application gets rejected, your CIBIL score also goes down.

- Taking Multiple Loans: If you take multiple secured or unsecured loans, it may decrease your CIBIL score.

- Loan Settlement: Credit card settlement or any other loan settlement type can make your CIBIL score extremely poor.

- CIBIL Report Error: Banks or NBFC companies mistakenly send the wrong information to CIBIL. Sometimes, data mixing also happens in the CIBIL report. It is a very typical problem in customer’s CIBIL report, and it’s not their fault. But the good news is it is very easily correctable.

Ways to improve CIBIL score

- Always Pay EMI on Time: Paying EMIs on time is essential for a healthier CIBIL report. Missing out on payments for your EMI bill can poorly impact your credit score. Set a reminder that may help you pay your EMI on time. Timely payments of your EMI bills will significantly improve CIBIL score.

- Don’t Take Too Many Loans: When you apply for multiple loans simultaneously, you seem credit hungry in the lenders’ eyes. The lenders can ask about your ability to repay the loan, which may ultimately lead to your loan application rejected. Avoid taking too many unsecured or short term loans at the same time. It is better to choose one loan at a time and pay it successfully to boost your CIBIL score.

- Never Choose A Settlement: Settlement of any loan or credit card will undoubtedly damage your whole CIBIL report. Sometimes customers face economic difficulty and make continuous delay payments. I advise you to clear the entire due sometime letter but never go for a settlement.

- Check For Unknown Errors: A study found that approximately 20 per cent of customers have an error in their CIBIL report. You might have a good credit history, but still, there can be several unknown errors in your CIBIL report. It could contain incorrect information or delay updating necessary details. These errors can negatively affect your CIBIL score. Monitoring your CIBIL score frequently will help you to notice whether there is any incorrect information shown or not.

- Create Dispute Immediately: Whenever you identify any incorrect information shown in your CIBIL report, make sure to create a dispute immediately by visiting the official website www.transunion.com. You have to correct any inaccurate information as early as possible to improve your CIBIL score.

6. Pay Credit Card Bill Timely: Usually, paying dues on time prevents interest from the uprising and helps improve your CIBIL score in the long run. The same goes for your credit card bills, and paying outstanding due Timely can improve CIBIL score.

7. Avoid Being A Joint Applicants: You may probably suffer a situation where you are not at fault. When someone else has taken a loan, and if you are the joint applicants, you may face such a scenario. Suppose they have defaulted on payments; you would also lose your score, and it will reflect in your CIBIL report. Start Monitoring whether the cards or loans are being paid on time. Avoid yourself becoming a joint applicant help you to improve CIBIL score.

8. Don’t Make Frequent Inquiries: A higher number of loan inquiries can easily pull down your CIBIL score. If your loan or a credit card application gets rejected, CIBIL will record the information in your report. It’s better to avoid those activities and first try to improve your CIBIL score. Ensure you meet all eligible criteria of the respected bank before applying for a loan or credit card.

9. Go For A Longer Tenure: Always Choose longer tenure to repay your due while taking a loan. In this way, your EMI will be signified low, and you can easily make all the payments on time. Also, you will keep yourself away from the defaulter’s list and will improve CIBIL score.

10. Limit Credit Utilization: Limit your credit utilization. If you have a credit card limit of 1 lac. Then you should utilize 25% to 30%. If you have a cash credit or OD limit, you must not do over the limit.

Read Also –

– CIBIL Score repair agency in Kolkata

– How to check free CIBIL Score

Pingback: What is the difference between CIBIL Rank and CIBIL Score?

Pingback: Credit Score Repair Agency 2021 - Naskar Financial Services